| Find the optimum product

mix

|

|

The problem is to find values of P and Q that

maximize the objective of the problem. We use the Mathematical

Programming add-in to generate the model in Excel.

The model is then solved with the Excel

Solver.

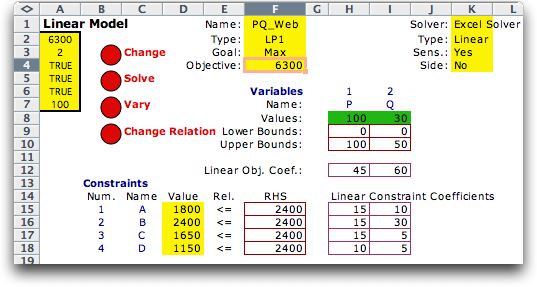

The worksheet with the model is shown below. Notice that the

model has four constraints

representing the machine times. The market constraints on production

are represented as simple upper bounds. These could have been

included in the constraint set, but using simple upper

bounds provides a more compact model.

The solution is shown under P and Q in row 8. The optimum

solution is to produce 100 units of P and 30 units of Q.

The net profit of this solution is $300. That is the $6300

shown in cell F4 on the worksheet, less the $6000 operating

expense. The latter was not included in the model because

it does not affect the optimum decisions. Constant values are

never included in the objective function. |

Find the bottlenecks |

|

From the value column for the constraints, we

see the amounts of time required by the optimum production quantities.

Clearly, the time on machine B is a bottleneck for this situation.

The market for P is also a bottleneck because the optimum value

is the upper bound for P. If either the time on machine B or

the market for product P are increased, the profit will increase. |

Find

the range over which the unit profit may change |

|

This result is determined from the sensitivity analysis. We show below the sensitivity analysis created by

the Excel Solver. The part of the analysis labeled Adjustable

Cells provides information concerning the variables and the

objective function. Each row on this table represents a variable.

The Cell entry is the Excel reference to the cell holding

the variable value for the optimum solution. The Name is

provided by the name appearing above the value cell on the

model worksheet (row 7). The Final

Value is the amount of that variable for the optimum solution.

The Reduced Cost is the change in the optimum objective

per unit change in the upper or lower bounds of the variable.

Since the final value of P is equal to the simple upper bound,

the reduced cost tells us that the objective function will

increase by 15 per unit increase of that upper bound (100).

Neither the upper or lower bound for Q is restricting, so its

reduced cost is 0. The reduced cost really represents a derivative

of the objective function with respect to the variable bound.

It may be true that a unit change cannot be made without some

other constraint becoming tight.

The Objective Coefficient column provides the current

value of the objective coefficient. The next two columns tell

how much that coefficient can change before the optimum solution

changes. We see that the Allowable Increase in the objective

coefficient for P is essentially infinity and the Allowable

Decrease is 15. This means that the unit profit (objective

coefficient) can range between 30 and infinity while the current

solution ( P=100 and Q = 30) remains optimal. The unit profit

of Q can range between 0 and 90 with the current solution remaining

optimal. It should be emphasized that these ranges are correct

only if one profit coefficient is changed at a time. |

Find the marginal

benefit of increasing the time availability |

|

The part of the sensitivity analysis labeled

Constraints, gives information concerning changes

in the constraint right-hand sides. Each constraint provides

a row on this table.

The Cell entry is the Excel reference to the cell holding

the constraint value. The Name is provided by the name

to the left of the value cell on the model worksheet (column

C). The Final

Value is

the amount of the constrained quantity used by the optimum

solution.

In this case it is the machine time used.

The column labeled Shadow Price gives the marginal

benefits of increasing the time availability. For machines

A, C and D the marginal benefit is zero. Since these machines

are underutilized, there is obviously no benefit for providing

additional minutes.

The shadow price for machine B is 2. This means that an extra

minute of machine time yields an increase in profit of $2.

This number is valid throughout the range indicated by the

last two columns. That is, for product B, the shadow price

of 2 is valid for any availability between 1500 and 3000 minutes. |

Find the range over

which the time availability may change |

|

The Allowable Increase and Decrease columns

give the change in the constraint limit within which the current

basis remains optimal. This means the bottlenecks remain the

same in this range.

We learn from the row for A that the machine availability

can go as low as 1800 and as high as infinity. Of course this

is reasonable because this constraint is loose with 600 unused

minutes for the machine. Similar comments can be made about

machines C and D.

The range for machine B is from 1500 to 3000 minutes. Since

this constraint is tight for the optimum solution, certainly

as the time available for B changes, the amounts of products

P and Q must change. The interesting result is that the time

on machine B and the market for P remain the bottlenecks within

the range. |

Parametric Analysis |

| |

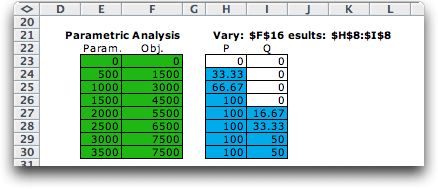

The Vary button on the

worksheet provides a parametric analysis where a single number

is varied

over a range and the optimum reported for several values. For

the example, the time available for machine B is an important

parameter, so we vary that value from 0 to 3500 minutes in steps

of 500 minutes with the following results.

The add-in provides a graph of the objective

as a function of the parameter. The limits observed in the sensitivity

analysis for the right-hand side of the second constraint

are clearly evident in the results. Below 1500, the

variable

P is basic, while Q is not. In the range 1500-3000, the variable

Q is basic, while P is non-basic at its upper bound. Neither

P nor Q is basic above 3000. Both are non-basic variables at

their upper bounds.

|

| |

|