|

|

|

Dynamic

Programming

Examples |

|

-

Revenue Management Model |

|

Revenue management

is one of the successful applications of operations research.

It is used throughout the transportation industry and could

be valuable whenever a business has a fixed capacity resource

that is used on a regular schedule. Examples are airline flights,

hotel accommodations, batch processing machines and many others.

All these examples require a major fixed cost for providing

a service. The cost is independent of the number of customers

who pay to use the service. To maximize profit, the business

wants as many customers as possible who individually pay a

high price for the service. In most cases there is tradeoff

between these goals. The maximum number of customers can only

be obtained with a low unit price, and the highest unit price

results in the fewest customers. Since the cost is fixed, the

goal is to find the combination of pricing and customer demand

to maximize total revenue. This problem is addressed through

revenue management. The example on this page is one of the

simplest of the revenue management problems.

An example is an airplane used in a commercial setting.

A small airline runs flights between

several small cities, and this problem considers a single

flight from one city to another. The plane flies a

weekly schedule between the two cities and has

a capacity of 20 passengers. For some time the airline

has operated using a fixed price per ticket of $120.

The cost of operating the flight including capital investment,

fuel, pilots, and stewards is $1,800. When

the plane is full, the revenue for the flight is $2,400,

so the airline clears a profit of $600. Unfortunately,

because of an economic downturn, the plane

has been carrying an average of only 14 passengers. This

yields a revenue of $1,680 for a net loss of

$120 per flight. Since the costs are fixed, the best

way to increase profit would be to sell more

tickets and increase the revenue per flight. |

The commodity for sale is

an airplane seat. Although every seat performs the same

function of carrying a customer from one city to the other,

various benefits can be made available to allow some seats

to be priced higher than others. Benefits include early

check-in, free drinks, pillows or blankets. Lower priced seats

do not enjoy these perks and are more restricted. Restrictions

include the inability to change or cancel the reservation

or the requirement to stay at the destination city over Saturday

night. Some tickets might be offered at lower prices just before

the flight. Selling a ticket for a seat that would otherwise

be empty always increases the total revenue.

In some manner, the market for the product

must be segmented into several classes: 1, 2, … m.

The classes have different prices with the price

decreasing with increasing class index.

|

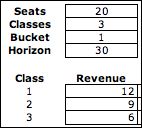

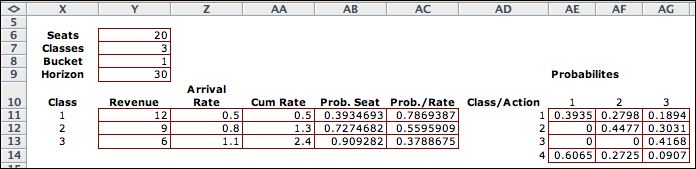

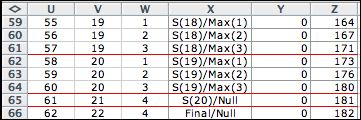

The data at the left is used as an example.

The capacity of the plane is 20 and there are three price

classes. Time is divided into buckets, here defined to

be one day long. Tickets

are available 30

days before the flight leaves (the Horizon). |

|

Reservations |

|

The flight

leaves at a scheduled clock time. We divide the time before

the plane leaves into equal intervals called buckets.

The buckets are numbered to indicate the number

of buckets before the plane leaves. The plane leaves at time

0. One day before departure is time 1, and so on. N is

the number of time buckets between when the airline begins

to sell tickets and when the plane leaves.

Customers make reservations

though the internet. To control the number of customers

that will be accepted from each class, each time bucket is

assigned a class number that indicates the maximum class

index that is acceptable.

For this problem we assume that only one reservation

is booked during a time bucket. Customers in the different

classes arrive independently at random times described by a

Poisson process. The action is to specify the value of x for

each state in each time bucket. We

assume that the first acceptable customer that arrives during

a bucket is booked.

Customers arriving later than the first in a bucket are lost.

This may seem to be an unrealistic assumption, but the model

can be made more accurate with smaller duration buckets.

The chart below shows one solution for the problem. The horizontal

axis is the number of days until the flight departure.

The vertical axis is the number of seats that are full. The colored

cells indicate the policy for each combination. For green cells,

reservations are accepted for all three classes. In yellow cells,

reservations are allowed for classes 1 and 2.

Only class 1 is accepted in the red cells.

A solution like the one shown is reasonable. When there is only

day to go, empty seats should be sold for any price, since a

seat not sold provides zero revenue. At earlier times when

only a few seats are left, it is better to restrict reservations

to make sure there is opportunity for higher paying customers

to buy seats. Early in the reservation process, it is better

not to sell the cheaper tickets so that space will

be available if more expensive tickets are requested later. No reservations

are accepted when the state reaches the capacity of the plane. |

|

| |

In the MDP model the state

variable is the number of booked seats, and the stage variable

is the time bucket index. The

chart shows the optimum actions. For

bucket 1 the decision is 3 for all states less than 20, the

capacity of the plane. For bucket 2, the decision is to accept

reservations of all types unless the state is 19, one less

than the capacity. In state 19 we book only classes 1 or 2.

In bucket 30, reservations begin with no seats booked, no reservations

are accepted at price 3.

The time between arrivals

for each class is assumed to be exponentially distributed.

Different classes have different arrival rates. The exponential

assumption allows computation of the probability that no acceptable

arrival occurs during the time bucket and the probability of

booking a customer from each acceptable class. For this model

we assume that arrival rates are independent of time, so the

parameters are not indexed by the bucket number. This means

that the model is homogeneous in time.

The decision problem is to assign a class

index to each state and each time bucket. No reservations are

accepted for classes with indices at above the maximum. The

goal is to maximize the expected total revenue over the time

horizon. |

Model |

| |

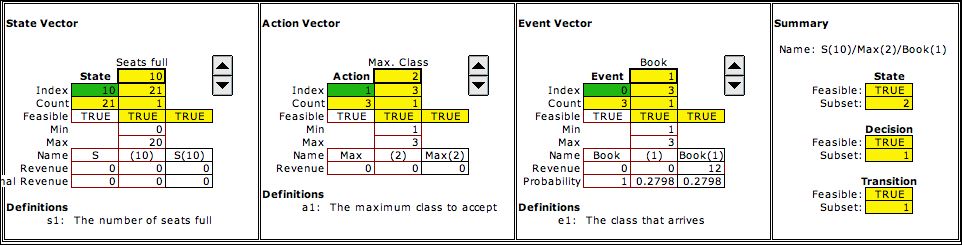

We model this problem as

a Markov decision process (MDP). The number of seats taken

is the state variable. The stage variable is the bucket index.

Since the model for each stage is the same, the stage variable

does not appear in the model formulation. You will see that

the effect of time is considered by the computational process

of solving the model. The action is the selection of the maximum

class index to admit. The event is the index of the class of

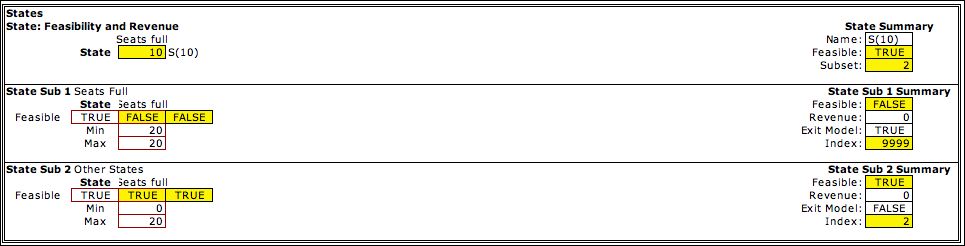

the arriving customer. The figure shows the state,

action and event variables defined on the DP model worksheet.

|

|

| |

The example shows the model

with 10 seats full, the action is to accept reservations of

class 1 or 2, and the event indicates that a customer of class

1 has arrived during the interval. The ticket is booked. The

event element holds formulas that describe the revenue and

probability associated with the event. These formulas link

to a data table constructed to the right of the model and illustrated

below. Changing this data automatically changes the related

cells of the model.

The event of no arrival is modeled implicitly.

When the DP Models add-in creates the model, it automatically

creates a null event that holds all unspecified probability

for a given state/action combination. This null event represents

the situation when no acceptable class arrives during a time

bucket. |

States |

| |

The state variable ranges from 0

to the capacity. The first state set indicates that state 20

is an exit state. No customers are added after the plane is full.

The second set covers all the other states. |

|

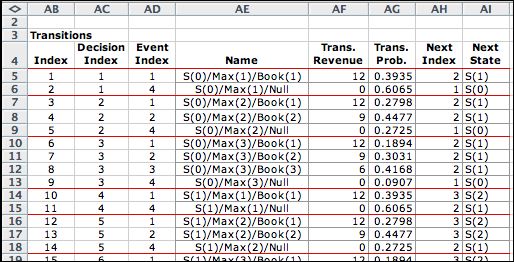

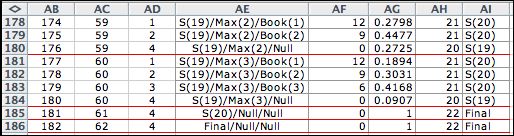

Transitions |

| |

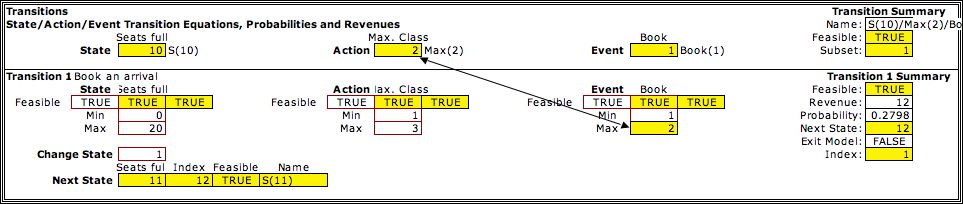

A single transition block advances

the state variable by 1 when an acceptable customer is booked.

The constant 1 is placed in the Change State cell. The

maximum event cell is set equal to the action variable. During

the model generation, whenever a state/action/event

combination satisfies the bounds on the elements, a transition

is created. The figure shows the transition from state 10 to

state 11 when the action is 2 and the event is 1. A class 1 customer

arrives and is booked. The revenue from the event in the summary

column is 12 and the probability is 0.2798. The revenue

and probability are computed in the event element. |

|

Lists |

| |

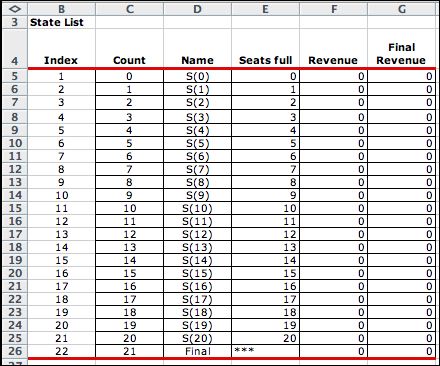

When the add-in is called to generate

the solver model, five lists are created as shown below.

|

The state list shows all possible states for

the system. A Final state is necessary for the transition

from state 20 to the exit. |

|

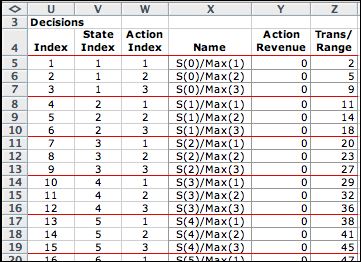

The three actions are to set the maximum acceptance index

to 1, 2 or 3. |

|

The event list shows the classes that might be booked during

the time bucket. |

.

|

There are 62 state/action combinations, or decisions, that

are feasible for the model. State 20 allows

only the Null action. |

.

|

There are 182 transitions for this model. The transitions

carry the revenue and probability information. |

|

Optimization |

| |

Clicking the Transfer to DP Solver creates

the five lists and transfers them to the solver model

worksheet. The solution is on the next page. |

|

| |

|

|