|

|

|

Dynamic

Programming

Examples |

|

-

Sequence Model |

|

This example describes

a sequencing problem for a set of wells in an off-shore oil

field. We use it here to show the possibility of solving sequencing

problems with dynamic programming. The problem is addressed

in the paper: Optimal

Sequential Exploration: A Binary Learning Model, by J.

Eric Bickel and James E. Smith, Decision Analysis, Vol 3, No.

1, March 2006. The complete problem description, the model

and the solution technique are found the paper. Here we concentrate

on solving the stochastic DP using Excel. We

use the DP Models add-in to build the model. The model is

solved with the DP solver add-in. The solution obtained with

the add-in is the same as the solution given in the paper. |

Problem Description |

| |

The following is

a copy of the first paragraph of the paper that provides an

introduction to the topic.

| "The motivation for this paper began with a consulting

engagement for a client that wanted to prioritize

its deep-water oil and gas exploration program.

The client had grouped the oil and gas prospects

into clusters it believed to be geologically dependent

and wanted to understand how the results for one

well change the chance of success for the remaining

undrilled prospects and how this information

should affect the drilling strategy. Given that the

wells cost tens of millions of dollars to drill, an

optimal drilling program could generate significant

savings and make an otherwise unattractive exploration

opportunity economically viable. Researchers

exploring multiple related R&D projects face similar

problems—given dependent projects, which projects

should they pursue first?" |

In the following we deal with the problem of sequencing the

drilling of six wells. We characterize a successful well as wet,

and an unsuccessful well as dry. Data concerning the

wells is in Table 1. The Include column indicates

whether a particular well should be included in the sequence.

The p column

indicates the marginal (unconditioned on the sequence) probability

that the well will be wet. The EV|wet column

provides the expected net present worth of the cash flow of

a wet well, where the present worth value is computed at the

time of drilling. The EV/dry column

is the expected net present worth of a dry well. Since no future

cash flows are projected from a dry well, this is the cost

of drilling. The EV column

is expected return for the well considered alone from the other

wells. It is, computed by the formula:

EV = (p)*EV|wet + (1 - p)*EV|dry

Table

1. Example Well Data |

Well |

Include |

p |

EV|wet |

EV|dry |

EV |

1 |

1 |

0.35 |

60.00 |

-35.00 |

-1.75 |

2 |

1 |

0.49 |

15.00 |

-20.00 |

-2.85 |

3 |

1 |

0.53 |

30.00 |

-35.00 |

-0.55 |

4 |

1 |

0.83 |

8.00 |

-40.00 |

-0.16 |

5 |

1 |

0.33 |

40.00 |

-20.00 |

-0.20 |

6 |

1 |

0.18 |

80.00 |

-20.00 |

-2.00 |

In this problem we have the choice of drilling the well or not.

Based on the EV values in the table, none of the wells should

be drilled. There may be benefits to considering the wells in order,

however. When

wells are drilled in sequence, the probabilities of wet or dry

of a particular well may be affected by the success or failure

of wells drilled earlier in the sequence.

Estimating the conditional probabilities is

a major topic of the Bickel/Smith paper, but here we do not attempt

to explain it. Through a series of questions to company experts,

the researchers were able to compute the joint probabilities

of complete scenarios. These are repeated

from the paper in the table below. A scenario indicates the results

for all six wells. Each scenario is described by a vector of

6 binary variables, with 1 indicating a wet well and 0 a dry

well. For example one scenario is that all six wells are dry

as shown as the first entry of the list , (0, 0, 0,

0, 0, 0). The probability of this scenario is estimated by the

methods in the paper to be 0.0343. There are 2^6 or 64 scenarios.

We seek a sequence of drilling the wells that yields the maximum

expected net present worth of oil field. The solution is not

a deterministic sequence that is specified before any wills are

drilled. Rather, the solution is a sequential decision rule that

specifies the next well to drill, given the results for the wells

drilling previously. This is called a policy. For example, if

the policy is to drill 3 first, the next well in the sequence

depends on whether well 3 is wet or dry. If it well 3 is wet,

the next well to drill might be well 6. If well 3 is dry, the

policy might be to abandon the field and drill no more wells.

To find the optimum policy we use stochastic dynamic programming.

We first use the DP Models add-in to model the problem, and then

use the DP Solver add-into find the solution. We use the table

below to find event probabilities. |

|

|

|

Dynamic Programming Model |

| |

|

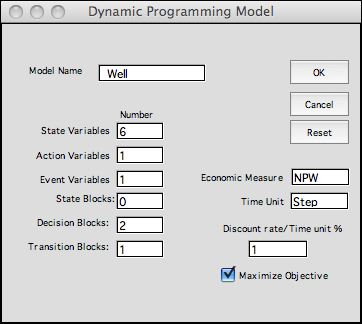

To create the DP model, select Add Models from

the DP Models menu. On the ensuing dialog choose the MDP option.

That presents the dialog to the left. The model consists

of states defined by six state variables, one action variable

and one event variable. We discuss the elements below. |

|

Model Elements |

| |

|

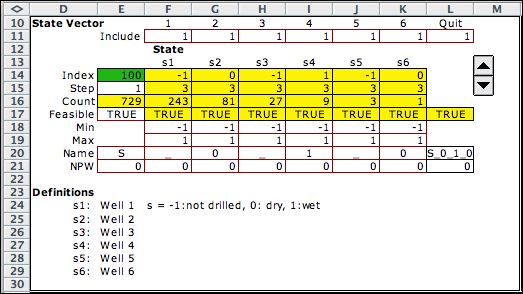

The state

definition has six variables corresponding to the six wells.

Each variable takes on three values, -1, 0 and 1. The value

-1 indicates that the well has not yet been drilled. The

0 value means that the well has been drilled and found

to be dry. The 1 value means that the well has been drilled

and found to be wet. The count row indicates that there

are 729 feasible state vectors.

Cell E17 holds logical conditions that determine if a

given state is feasible. For this problem only the variable

bounds determine feasibility, so cell

E17 is set to TRUE.

The range labeled Include is provided to restrict

the wells to be considered. A value of 0 would indicate

that the associated well would not be drilled. All wells

are included for this example. State names are determined

in cell L20. An underline indicates that the well has not

been drilled and 0 and 1 are used to show the results of

drilling.

States do not affect the objective value directly so row

21 has all zeros. |

|

A second state is shown for comparison. The states are

enumerated by changing the index in E14. Each integer value

represents a state. The index of 100 determines the state

with wells 1, 3, and 5 not drilled. Well 2 is dry, well

4 is wet, and well 6 is dry. |

|

The action is described a single variable specifying

the next well to drill. The example selects well 3. A value

of 7 indicates that drilling is abandoned.

The enumeration includes all 7 values of the action variable,

but a logical expression in the feasibility cell (O17)

restricts actions to the set of wells included in the problem

and specified in the range F11:L11. The logical expression

in O17 is:

=INDEX(F11:L11,1,Well_DPM_Action)=1

The result is TRUE when the entry in the

range corresponding to the action is equal to 1.

Otherwise it is FALSE.

Again the action has no direct effect on

the NPW. |

|

The event vector has only two values, 0 representing

dry and 1 representing wet. The event holds the NPW contribution

and probability associated with the result. The NPW is the

value at the time of drilling. The transition equations will

further discount the value to the beginning of the study

period.

The probability of the wet result is computed from

the scenario probabilities given in the table above. It

is the probability of success of the well given the results

of all drilling that occurred earlier in the sequence.

The probability does not depend on the sequence of the wells,

only on the set of drilled wells and whether they were

wet or dry. This information is provided by the state variable.

The example shown is for the state with no drilled wells,

so the probability of the wet result for well 3 is simply

the marginal probability from table 1. The NPW contribution

is from Table 1. |

|

The same event for the state S_0_1_0 is shown at the left.

Note that the conditional probability of well 3 being wet

has been changed by the state. This probability depends on

the scenario probability data given earlier. The formulas

providing this result are on the worksheet for this example. |

|

| |

|

Clicking the List States button

at the top of the page, creates the list shown in part

to the left. Including the Final state

at the bottom of the list there are 730 entries on the

list.

This list and all the other lists described on this page

are on the worksheet named Well Lists. |

|

Decisions |

| |

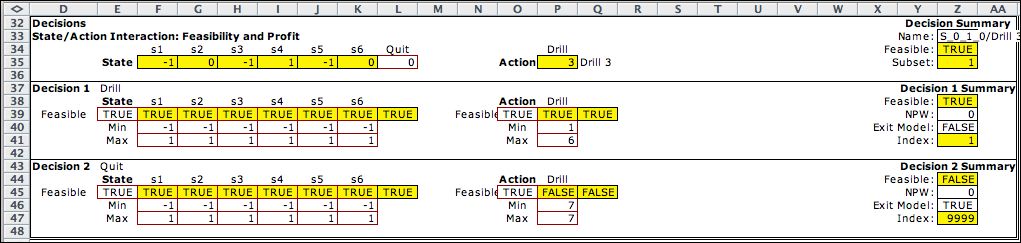

Two decision subsets are defined

in the model. The first describes the set of actions regarding

drilling a well, as indicated by the upper bound of 6 on the

action variable for the Decision 1 subset. The logical cell

O39 is interesting because it only allows actions on wells

not yet drilled. The logical expression implementing this is:

=INDEX(F35:L35,Well_DPM_DecAction)=-1

The range (F35:L35) holds the state vector plus a cell that

represents the Quit decision. Cell P35 has the name

"Well_DPM_DecAction". The expression allows only

wells that have a -1 in the corresponding state vector. Cell

L35 is included so the expression will not generate an error

for action 7, Quit. Errors occurring with the INDEX function

cause the program to prematurely terminate.

The second Decision subset is only for action 7, Quit. That

action is identified as an Exit state with the value

TRUE in Z46. |

|

| |

|

Clicking the List Elements button

at the top of the page, creates the Decision and Transition lists.

The decision list combines feasible states

with feasible actions to obtain feasible decisions. The

first six decisions are for the state with no wells drilled.

As drilling results are added, the number of feasible decisions

decrease. There are 2188 decisions for this model. |

|

Transitions |

| |

The transitions move the system

from the current state to a new state. The new state

depends on the current state, the action, and the event. The

transition is affected through the Change

State range

in row 61. The equation in cell F61, refers to the action and

event. When the cell represents the current action, the state

is changed by adding +2 for a wet well and +1 for a dry well.

The formula uses the Excel IF function.

=IF(Well_DPM_TransAction=F60,Well_DPM_TransEvent+1,0)

The objective term is reflected in cell Z57 and the probability

of the event is in Z58. |

|

| |

|

The program combines all feasible decisions

with each of the event possibilities to obtain the Transition

List. The first few and last few transitions are

shown at the left. There are 3646 feasible transitions. |

|

| |

We see at the end of

the list, the Final State. The final state has a transition that

returns to itself. Except for the final state the transitions

from all states go to a state with a greater index. This kind

of state network is called an acyclic network because there

can be no cycle leading from one state back to itself. |

Summary |

| |

This particular model is for the well sequencing

problem, but many of its features could be adapted to other

sequencing problems. It is a fairly large problem for our Excel

DP Solver, but once constructed it is solved readily. We discuss

the solution on the next page.

|

| |

|

|