|

|

|

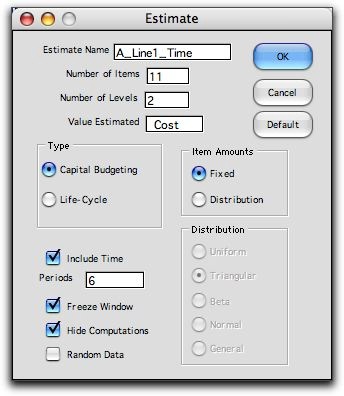

Estimate |

|

-

Time Dimension |

|

It may be desirable to construct a cash flow for the project

that indicates the expenditure of money over time. For an example

we use the WBS with only two levels of detail. This makes the

graphics and data simpler, but similar results can be obtained

with any level of detail. To add the time dimension, click

the Include Time box as shown below. Also enter the

number of periods of the analysis. For the example we assume

the project will take six months. |

| |

|

| |

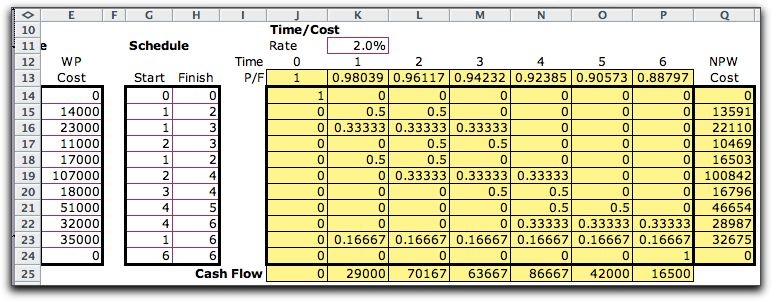

In addition to the

WBS, two columns are provided to specify the start and end

time of each activity. |

| |

|

| |

To the right of the

schedule there is a time/cost display showing the six month

period with an additional column for time 0. Column J, for

time 0, holds investment amounts that occur at the beginning

the six month period. There are none for the example. Columns

K through P show how the work package costs are spread over

the six periods. The range is colored yellow to indicate that

it contains formulas. The models assume that the costs are

spread evenly over the intervals defined by the start and finish

columns. These formulas can be manually changed or replaced

by numbers for other distributions of cash flow.

The row at

the bottom of the display, row 25, holds the cash flows for

the six periods. An entry, say K25, is obtained by multiplying

the costs in column E by the proportions in column K. The cash

flows are interesting to the planner concerned with financing

the project. They will also be used for equivalency calculations

in other lessons. |

| |

|

| |

The numbers in row 13

are the present worth factors, identified by P/F. We will have

much to say about these factors later, but it is sufficient to

say at this point that when a cash flow occurs at some time t,

multiplying it by the P/F factor computes an equivalent value

for the cash flow at time 0 called the net present worth,

NPW. When we multiply a row in our time/cost matrix by the vector

of P/F factors, we obtain the equivalent value

of the entire row of cash flows. We see in column Q the NPW value

for each work package. For positive interest rates, NPW values

are less than the total cash flow. For example, the

cost of 14,000 in row E15 results in a NPW of 13,591. |

Summary |

| |

Clicking the Summarize button at the top of the

page summarizes the total NPW values for the second level activities

and an estimate of the NPW of the entire project. These depend

on the interest entered in cell K11. With an interest rate

of 0, the NPW values are the simple sums of the cash flows

over time. |

| |

|

| |

All the results cells

that are colored yellow hold formulas that recalculate automatically

if any data item is changed. Thus the display is dynamic. |

| |

|

|