|

|

|

Estimate |

|

-

Life-Cycle Costs |

|

The life-cycle cost, LCC, is the sum of all expenditures

less receipts from origination of the project to disposal of

the system. In additional to the capital costs, the LCC includes

the operating costs and revenues for each year of the life

cycle as well as the disposal cost. When an interest rate is

defined, the LCC is the net present worth rather than the sum.

For this analysis we need a new structural definition,

the cost breakdown structure or CBS. This structure is similar

to the WBS in that it uses a numerical classification system.

Rather than enumerate the activities in a project, however,

this structure enumerates the cost and revenue components of

the life-cycle cost.

There are two problems associated with LCC. The

first is estimating the annual operating cost and revenue.

For systems with some complexity, this is not a small problem

since there are usually a great number of parts associated

with a typical product and a corresponding large number of

individual estimates required. The second problem is estimating

the variation of these costs (and revenues if appropriate)

over time. The life of a typical life cycle may be several

years and the factors that affect cost estimates may well change

over time. Although we use years in this discussion,

any time interval can be used.

The add-in offers two options for cost estimation:

with time and without time. The with time option

estimates the cash flow in each year over the analysis period,

usually the life of the system. The without time option constructs

a form to estimate unit cost as a function of production volume.

We illustrate the without time option on another page. |

Example |

| |

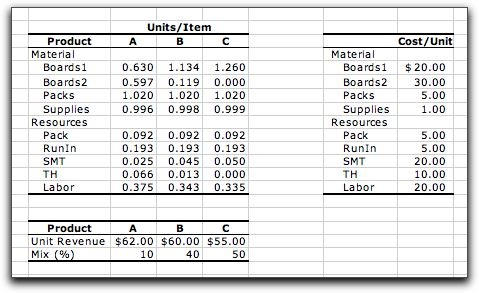

To illustrate,

we consider again the assembly line design project described

in the capital budgeting page. Here we describe the products

that the assembly line will produce once installation is complete.

The line produces three products: A, B and C. The characteristics

of the products are shown in the tables. Manufacturing the

products uses materials and resources. Materials include the

parts and supplies that go into the product. Resources describe

the machines and labor that are used for production. Materials

must be replenished after use. Resources use time and time

is also limited. The materials

and resources are listed by name for the example in the table

on the left.

Each product uses different amounts of materials

and resources. These are shown

in the columns labeled units/item. The word

unit refers to a unit of raw material, and the word item refers

to a single finished item. The

table on the right shows the costs per unit for the materials

and resources. The table at the bottom shows the revenue per

finished item for the products as well as the product

mix. The latter is the proportion of the total production devoted

to each product.

The materials and resource units may not be measured

using the same dimensions. For example, resource usage is typically

measured in time dimensions, such as hours, while material

usage is typically measured in quantity dimensions, such as

pounds or part count. For example, the cost for

the first board type is $20 per board, while the cost for labor

is $20/hour. To compute the cost for a component we multiply

units/item by cost/unit and the dimension of the measurement

cancel out. It is important that the dimensions be consistent.

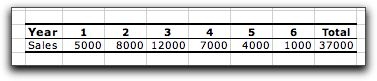

The markets for the products are expected to last

six years. The anticipated annual sales for all three products

are in the table below. We see that production is expected to

grow in the first few years and then decline.

On this page we use this example to estimate

the life-cycle cost of the assembly-line system. We use

the capital cost computed earlier, but assume the disposal or

salvage value of the line is zero. We first analyze a single

product, A, to keep the example small, but then we consider all

three products. |

Add Form |

| |

To create a life-cycle

cost worksheet, choose Add Estimate from the menu,

and fill out the dialog as below. With only product A, this

example has 17 items and four levels of detail in the CBS.

Clicking the Life-Cycle button

creates the CBS rather than the WBS. For the example we include

six time periods.

|

| |

The

data for the CBS is similar to the WBS, except in a few details.

The structure identifies levels of the product structure. The

system is assigned to level 1 with the index 1. We use level

2 for the product definition and to segment between cost and

revenue. Items 3 through 14 are costs, while item 15 is revenue

from sales (entered as a negative cost). Level 3 is used to

divide the cost components into material, resources and overhead.

Level 4 identifies the individual cost elements. Each line

in the CBS is unique with respect to the indices assigned to

the levels. Item 16 holds the installation cost computed on

the capital budgeting page. |

|

| |

The columns

N1 through N4, columns G through H in the worksheet, hold numbers

that compute the total number of units required for each item

of finished good. Usually 1 is used for N1. N2 is the number

of level 2 items used for each level 1 item, N3 is the number

of level 3 items used in the level 2 item, and so on.

For the present case our data specifies the

number of units per item directly and that is entered in column

N4. For example, we see that for each item of product 1, 0.63

Board 1 components are required.

The Units/Item column, column K, holds

the product of the number columns. The number columns are useful

for describing the product structure. We illustrate an interesting

case in the Automobile example on another page.

The cost

of production for a given period depends on the production

volume of the product. The model includes a fixed cost that

is independent of the amount produced and a variable cost.

These are entered in columns L and M respectively. The item

cost, computed in column O, is the variable cost multiplied

by the number of units per item, so it is the variable cost

per unit of production of the system.

Sometimes

the variable cost of some item depends on the costs of several

other items. For example, it is common for the overhead

cost to be a percentage of total labor costs. We include the subtotal column

to compute the total labor cost or any other quantity that

might be relevant to the estimation. The subtotal column is

not used for other computations on the worksheet unless the

subtotals are used explicitly in formulas expressing other

data on the worksheet.

In the example, overhead

item, 14, is 40% of the labor cost, item 13. Since this is

the only labor item on the CBS, the overhead is included as

a separate item and the subtotal column is not used.

The Quantity entry in cell H11 is useful

when the estimate is to be for a production lot of an

integer number of finished items. Here we use the default value

of 1. |

Time |

| |

To obtain the life-cycle cost we construct a table that has

a column for each year of the life cycle and also a column

for time 0. An entry in the table is a multiplier that indicates

how much a particular item contributes to the cost for that

year. We compute the cash flow for the years of the life cycle

with this table. Click the picture to open a larger version

of the cost/time table. |

|

| |

The model used for the cost contribution of item i in

year k is shown below. The cost/time table describes

the multipliers. The fixed cost is in column L and the variable

cost is column O. The result of the computation is not shown

directly on the worksheet but is used to find the cash flow

for each year and the NPW for each item.

Although we see mostly 1's in this matrix, the

coefficients can be altered to represent changes with time.

For instance, if the costs are increasing with inflation, the

numbers in the columns will grow as the year index increases.

A column is included for time 0. This is the

start of the life cycle and any initial investments can be

placed in this column. For the example we see a lone 1 for

item 16, representing the capital cost of the line. Although

the capital cost is spread over several months as illustrated

on the capital budgeting page, for this larger time horizon

we usually place the capital cost at time 0. If, in fact, the

capital cost spreads over several years, the contribution in

each year is indicated by the multipliers.

The other columns are for the 6 years of the

product's life. At the top of each year we see the production

volume for that year. The data indicates that this quantity

varies with time. The cash flow at the bottom of each column

is found by summing the item contributions for the year.

The table below summarizes production

amounts and cash flows for the example. We see that except

for time 0, there is a profit for each year in the life. This

cash flow is typical for a profitable investment. The total

cash flow indicates that this system does yield a profit over

its life.

Year |

Prod. |

Cash Flow |

0 |

0 |

$308,000 |

1 |

5,000 |

61,539 |

2 |

8,000 |

98,463 |

3 |

12,000 |

147,695 |

4 |

7,000 |

86,155 |

5 |

4,000 |

49,232 |

6 |

1,000 |

12,308 |

| Total |

37,000 |

147,392 |

The NPW column computes the present worth for

each item. The present worth computation combines the individual

cash flows into a single equivalent value at time 0. It depends

on the discount rate that must be given. When the discount

rate is 0, the NPW is simply the sum of the cash flows for

an item. The formulas computing the quantities in NPW column

are below.

The NPW worth is used to evaluate the profitability

of an investment. When the NPW is greater than 0, the rate

of return for the investment is greater than the discount rate.

When the NPW is less than 0, the rate of

return for the investment is less than the discount rate. |

Summarize |

| |

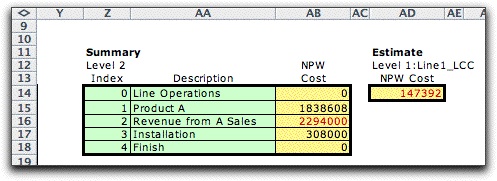

Two

buttons are placed on the life-cycle cost worksheet. One allows

the number of items to changed. The second creates a summary

form that computes the NPW for each set of items having the

same level 2 designation. For the example, the summary shows

the breakdown between operating cost, revenue and installation

cost. Again since we are using zero for the discount rate,

the NPW values are the sums of the costs. The total cost estimate

is shown at the right. Because the value is colored red, it

is negative. This means that the assembly line yields a profit

over its life.

|

The Three Product Example |

| |

The example has three

products: A, B and C. The CBS for this case lists the costs and

revenues for all three products. Click on the icon to see the

CBS in a separate window. Note that we show the product mix in

the N2 column. An item in this case is one unit of product. |

|

| |

The figure below adds

time to the analysis. |

|

| |

The cash flow values are taken from the bottom

of the chart.

Year |

Prod. |

Cash Flow |

0 |

0 |

$308,000 |

1 |

5,000 |

67,042 |

2 |

8,000 |

107,267 |

3 |

12,000 |

160,900 |

4 |

7,000 |

93,858 |

5 |

4,000 |

53,633 |

6 |

1,000 |

13,408 |

| Total |

37,000 |

188,109 |

The summary for this system is below. With three

products the total profit is greater than with only one.

|

| |

The

flexible data structure the Estimate add-in

can be used to estimate the life-cycle cost for a variety of

situations. |

| |

|

|