|

|

>  |

Teach

Dynamic Programming Add-in

|

|

-

Problem Models

|

|

|

The add-in comes with a series

of problem-specific models as well as a general

model that allows

the construction of DP models constructed by

the student. In this and the following pages

we describe each of the built-in models. This

page describes the model for the knapsack problem

in some detail. Other models are described in

general terms but with less detail on the DP

implementation.

The examples for this section are in the Teach

DP demo (teachdpdem.xls). The specific models

are described in the PDF supplement, Dynamic

Programming Models (dp_models.pdf). To solve

or change the model you must have the Teach

DP add-in loaded. Use the Relink buttons command

to establish links to the worksheet buttons.

|

|

Example Problem |

| |

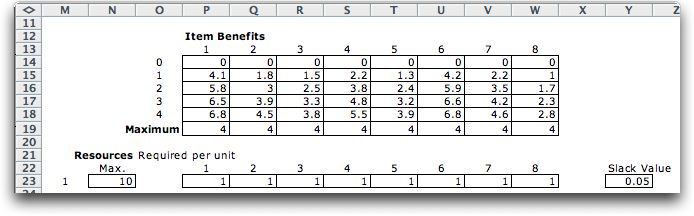

To illustrate using a built-in model

we use the Investment Problem considering in the Models

section of the site.

A portfolio manager with a fixed budget of $100 million is

considering the eight investment opportunities shown in the

table below. The manager must choose an investment level for

each alternative ranging from $0 to $40 million. Although an

acceptable investment may assume any value within the range,

we discretize the permissible allocations to intervals of $10

million to facilitate the modeling. This restriction is important

to what follows. For convenience we define a unit of investment

to be $10 million. In these terms, the budget is 10 and the

amounts to invest are the integers in the range from 0 to 4.

Table 1 provides the net annual returns from the investment

opportunities expressed in millions of dollars. For example,

an investment of $10 million in opportunity 1 provides an annual

return of 4.1 million. When time value of money is considered

this 4.1 would be considered the uniform annual equivalent

of the opportunity.

A ninth opportunity, not shown in the table, is available

for funds left over from the first eight investments. The return

is 5% per year for the amount invested, or equivalently, $0.5

million for each $10 million invested. The manager's goal is

to maximize the total annual return without exceeding the budget.

Table

1. Returns from Investment Opportunities |

Amount |

Opportunity |

Invested

($10 million) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

4.1 |

1.8 |

1.5 |

2.2 |

1.3 |

4.2 |

2.2 |

1.0 |

2 |

5.8 |

3.0 |

2.5 |

3.8 |

2.4 |

5.9 |

3.5 |

1.7 |

3 |

6.5 |

3.9 |

3.3 |

4.8 |

3.2 |

6.6 |

4.2 |

2.3 |

4 |

6.8 |

4.5 |

3.8 |

5.5 |

3.9 |

6.8 |

4.6 |

2.8 |

|

Problem Definition |

| |

|

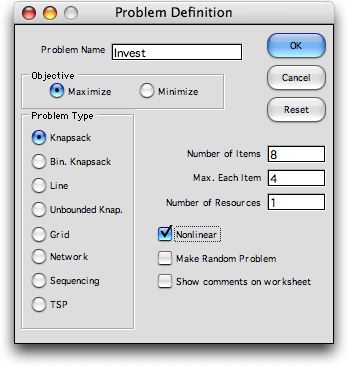

Selecting the Model option from the Teach_DP menu

presents the problem definition dialog.

Fields accept the problem name and relevant

parameters. Clicking a button on the left

selects one of the problem types built into

the program. We recognize the investment

problem as a knapsack problem with the opportunities

equivalent to items. The resource is the

budget limitation. We click the Nonlinear box

because the investment returns are not linear

with the amount invested.

The names of the fields at the right side

of the dialog a affected by the problem type

selected. The first checkbox label (here

labeled

Nonlinear) also depends on the type.

When checked, the Make Random Problem box

fills in the data form with random numbers

appropriate to the problem type. Of course,

these may be changed on the worksheet. The Show

Comments adds a small red label to some

of the cells of the worksheet.

|

After entering data and pressing the OK button, a worksheet

is created with the name specified in the dialog. Many ranges

on the worksheet are given Excel names with the preface being

the worksheet name, so that name should not be changed after

the worksheet has been constructed.

In the greater part of the worksheet the program constructs

the dynamic programming model consisting of the state and decision

definitions and all of the other components required for dynamic

program. The

problem specific data is placed to the right. We have entered

the data for the example in the tables provided.

|

| |

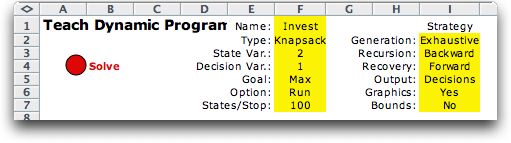

At the top of the

worksheet we see a variety of information describing the problem,

solution process, interaction and display. The Solve button

initiates the dynamic programming solution process.

|

| |

Without any knowledge of the DP

model, the user can click the Solve button to obtain

the solution below. Statistics of the solution process start

in column M. |

|

| |

Since the Graph option has

been chosen, the solution presents a graph of the state space.

There is a single initial state at (1,0). The nodes colored blue

are the final states. The gold colored states and the heavy lines

indicate the optimum path through the state space. The red lines

indicate the optimum decisions for the states. The total number

of states with exhuastive enumeration has 88 states with S1 between

2 and 9 and S2 between 0 and 10. The single initial state provides

the total number of 89. |

| |

|

Excel Model |

| |

A DP model uses states and decisions

to describe a sequential decision process. A number of functional

expressions define the beginning, middle and end of the process.

A quantitative measure determines the costs and/or benefits

of the process.

When using this DP add-in for Excel, the expressions describing

the model must be placed into cells as Excel equations. All

DP model information is placed in first few columns of the

worksheet (the number of columns depends on the number of state

variables and decision variables). Regions outside the model

definition can be used to hold problem specific data or equations.

We show below the Excel worksheet for the investment example.

This is an instance of the knapsack problem with one decision

variable and two state variables. Areas colored green hold

formulas when the worksheet is constructed, but the contents

may be changed by the user. This is useful when building models.

During the solution process the computer manipulates the green

areas during the various steps of the process. For the built-in

models, the user need not be concerned with the green areas.

Areas colored yellow hold equations or data required by the

program during the solution process and should not be changed

by the user. Ranges outlined in red hold Excel equations that

describe the dynamic programming model. These equations can

be entered by the user, but in the case below they are filled

entirely by the computer specifically to solve the knapsack

problem. In the table below, we provide a brief description

of each of the model areas. In the General section,

the formulas are described in greater detail.

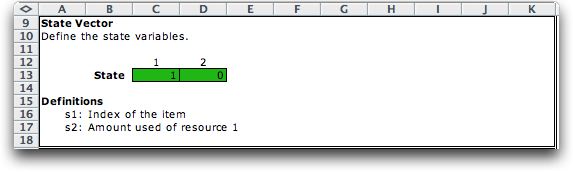

State |

A state is described by the opportunity index,  ,

and the amount already spent, ,

and the amount already spent,  .

The state variables are contained in the vector .

The state variables are contained in the vector  . The

state is in row 13. The state (1, 0) means that opportunity

1 is under consideration and the current resource devoted

to the portfolio is 0. . The

state is in row 13. The state (1, 0) means that opportunity

1 is under consideration and the current resource devoted

to the portfolio is 0.

|

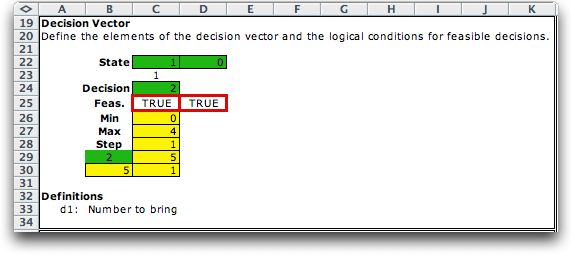

Decision |

The decision is the amount of the opportunity in the portfolio.

We use  for

the investment amount. The decision is in cell C24. Cell

B29 controls an enumeration process that places the five

values of the decision variable in cell C24. Row 24 holds

logical expressions that determine whether a given decision

is feasible. for

the investment amount. The decision is in cell C24. Cell

B29 controls an enumeration process that places the five

values of the decision variable in cell C24. Row 24 holds

logical expressions that determine whether a given decision

is feasible.

|

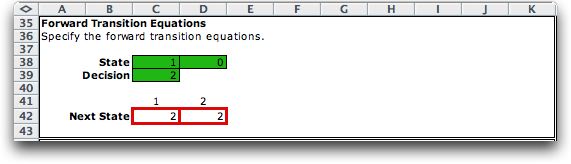

Transition function |

The transition function

determines the next state, s', reached when decision d is

taken from state s. With two state variable, we

need two transition equations. The formulas for these equations

are in row 42.

|

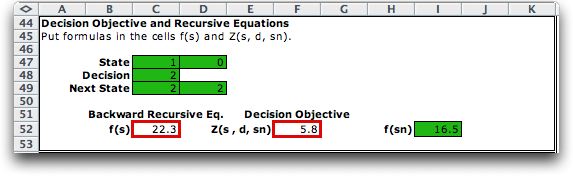

Decision objective |

z(s, d), the measure of effectiveness

associated with decision d taken in state s.

For the investment problem, the return is taken from the

table of returns. the value of  determines

the column number and the value of determines

the column number and the value of  determines

the row number. On the Excel form this table value is transferred

by equation to cell F52. determines

the row number. On the Excel form this table value is transferred

by equation to cell F52.

z(s, d) =  |

| Recursive Equation |

The recursive

equation is the value of the optimum policy starting from

state s,  .

For a given decision made from state s, the

value of the portfolio .

For a given decision made from state s, the

value of the portfolio  plus

the value of the next state, plus

the value of the next state,  .

The recursive equation evaluates the maximum over all feasible

decisions. .

The recursive equation evaluates the maximum over all feasible

decisions.

In Excel the number in cell I53 is provided

by the computer as the value for the next state. Cell C52

is a formula that computes the sum of F52 and C52.

The figure below illustrates the computation

of the values given above.

|

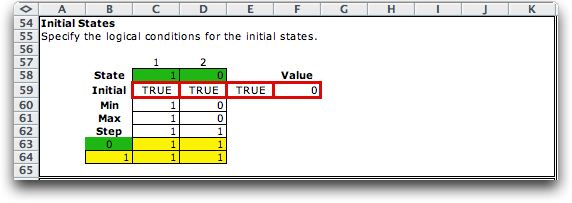

Initial state set |

I = {s : states where the decision

process begins}

The investment example has only one initial state I =

(1,0). The Excel model identifies the initial states by

the Min and Max limits in columns C and D, and the logical

expressions in row 59. Cell E59 is True for an intial

state. The initial value function

is computed in F59. For the example it is 0.

|

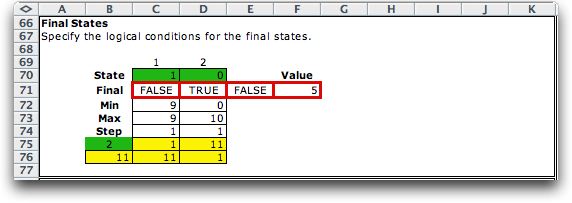

Final state set |

F = {s : states where the decision

process ends}

For the example the final state set is:  . .

The

Excel model identifies the final states by the Min

and Max limits in columns C and D, and the logical expressions

in row 71. Cell E71 is True for a feasible

state. The final value function,  ,

is computed in F71. ,

is computed in F71.

|

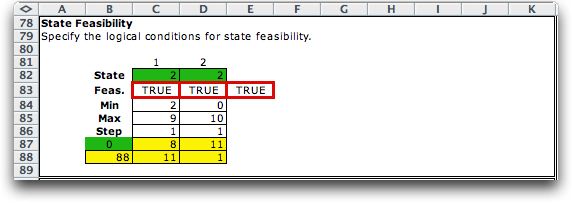

State space |

S = {s : s is feasible}

The Excel model identifies the feasible states by the

Min and Max limits in columns C and D, and the logical

expressions in row 83. Cell E83 is True for a feasible

state.

|

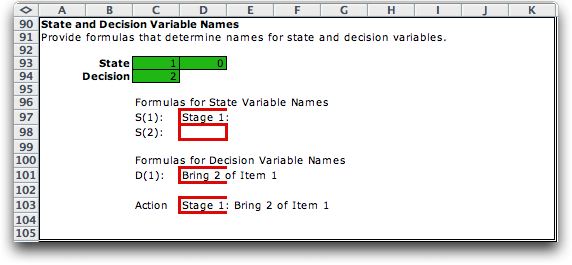

State and Decision Names |

This part of the worksheet is useful for output presentations.

Cells with red borders accept string expressions that provide

names for the states and decisions.

|

|

| |

|

|