|

|

>  |

Teach

Dynamic Programming Add-in

|

|

-

Line Partition

|

|

A class of problems for which dynamic

programming can be effectively applied involves the partitioning

of a line into non-overlapping segments. Applications include

production scheduling for finite time horizon, capacity expansion

of a production facility, and setting up inspection stations

along an assembly line. In the definition of these problems both

the state and decision vectors have a single component, making

them easy to solve. From a modeling point of view, they are illustrative

of the case where the classical stage representation for dynamic

programming is not appropriate. |

| |

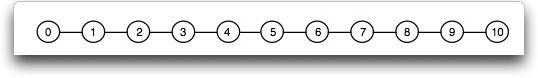

Consider a line, as with n+1

discrete points or nodes numbered 0 to n.

The problem is to find an optimal partition

of the line into segments such that each segment begins at

one node and ends at another. Some objective or payoff

function is associated with each continuous subsequence of

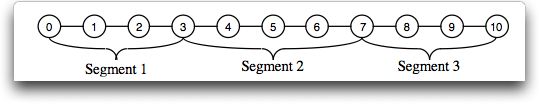

nodes, and is typically nonlinear. The figure shows one

possible partition.

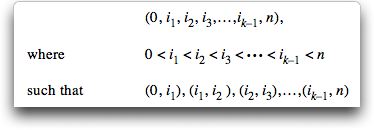

A

vector of selected nodes defines a solution, with each adjacent

pair of nodes defining a segment of the line. Thus a

general solution comprising k segments can be written

as a vector; that is,

Note that

the number of segments, k, is a variable in this problem.

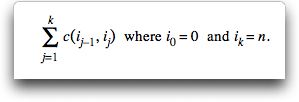

A

cost function is defined in terms of the nodes the comprise

the segments with c(i , j)

the cost of the segment starting at node i and terminating

at node j. The cost of a solution is the sum

of the segment costs. The goal is to minimize this cost.

|

| |

|

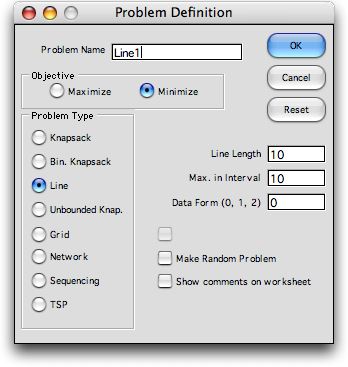

To make a model of this class, click the Line option

on the dialog. The line length is the number

of points in the line not including 0. Thus

when 10 is entered, the nodes on the line are

numbered 0 through 10.

The Max in interval entry is the

length of the maximum segment. In the figure

above, the center segment has a length of 4.

To reduce computation effort, this number might

be chosen as some number less than n.

There are three data form values 0, 1 and

2. We illustrate the three cases below.

|

|

Line Partition |

| |

|

For this case we adopt a simple

cost function for a segment that is it is

the number of nodes in the segment squared

plus a fixed cost. For the example we use

a fixed cost of 10. Thus for a segment passing

from node i to node j the

cost is

c(i, j)

= 10 + (j - i)^2

The definition of this cost function distinguishes

one model from another. There are no restrictions,

such as convexity, on the characteristics

of the function. One of the strengths if

dynamic programming is that it can be used

for all kinds of objective functions.

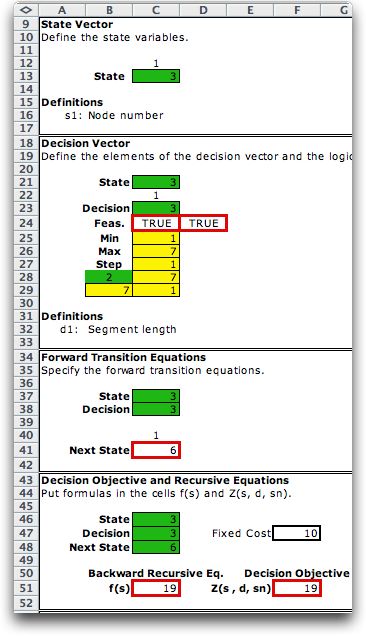

The model for this line problem is partially

shown at the left. The case illustrated is

for s=3

and d=

3. All

line problems have a single state variable

and a single decision variable. The maximum

decision value is set so that a segment does

not go beyond the last node.

The forward transition equation is:

s' = s + d

For the example s' =

6.

The add-in builds a worksheet

with all formulas and data structures automatically

provided. For some cases, the built in formulas

and data structure must be modified. In this

case the formula for the cost function is

placed in cell F51. The definition of the

fixed cost in F47 and the objective function

calculation in F51 is added to the model.

|

|

| |

Click the Solve button

at the top of the page to perform the dynamic programming algorithm.

For the example, we generate all feasible states first, and

then perform the backward recursion method of dynamic programming.

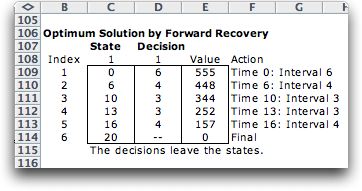

When the complete solution is obtained we use the forward recovery

method to return the solution. The solution is shown below

together with the statistics of the solution process.

|

Capacity Expansion |

| |

A power company expects a growth

in demand of one unit (100 megawatts) of power for each year

in the next 20 years. To cover the growth the company

will install additional plants with capacities in integer sizes

of 1 through 10. The size chosen will determine how many

years before the next capacity expansion is required. The

cost for the 10 sizes is shown below.

Size |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Facility Cost |

15 |

16 |

19 |

24 |

30 |

34 |

39 |

45 |

49 |

54 |

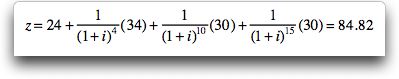

The goal is to minimize the present worth of the expansion

costs for the next 20 years. We use i to indicate

the interest rate for present worth calculations, and assume i =

5%. To illustrate how the objective function is evaluated,

say we choose to build plants in the size sequence 4, 6, 5,

5. This means that the expansions occur at times 0, 4,

10 and 15 so the present worth of the costs is

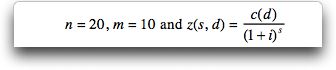

The situation can be modeled as a line partitioning problem

with

where c(d) is given in

the cost table as a function of the expansion size d. The

exponent of the discount factor is s, the year of

installation. In the DP model this is the state variable.

The problem is created in Excel with the Line option

on the model dialog. Here we specify the data structure option

as 1. The add-in builds the DP form and adds a single vector

to the right of the model (in column N). We have added the

entry in N9 to hold the interest rate. To complete the model,

place the function z(s, d) in cell

F51.

|

| |

Solving the problem yields the

optimum solution. A facility is built at time 0 of size 6.

The second facility is built at time 6 of size 6. At time 12

a facility of size 4 is built. Finally a facility of size 4

is built at time 16. The discounted cost of the plan is 83.73.

|

Production Scheduling (Wagner-Whitin algorithm) |

| |

A manufacturing facility has forecasted

demand for the next 20 weeks as shown in the table below. There

is a fixed cost for setting up a production run equal to f. In

addition, there is a variable cost v that is proportional

the number of items produced. If we produce more than

the demand in a particular week, the excess items are stored

until needed. The inventory cost is proportional to the

number of units and the number of weeks stored. The cost

per unit per week is w. The problem is to find

a production schedule that minimizes the total fixed, variable

and inventory costs. Demand data used for the example is below. |

Period |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Demand |

3 |

1 |

7 |

0 |

0 |

2 |

8 |

2 |

3 |

2 |

Period |

11 |

12 |

13 |

14 |

15 |

16 |

17 |

18 |

19 |

20 |

Demand |

9 |

4 |

1 |

8 |

3 |

3 |

8 |

6 |

5 |

5 |

|

| |

The appropriate dynamic programming

model is similar to that for the line partitioning problem. When

applied to the inventory problem, the approach is called the

Wagner-Whitin algorithm. The line to be partitioned in

this case is the time line. The nodes correspond to the

times {0, 1, 2,…,20}. A solution is described

by a sequenced set of times at which production occurs. For

this case n = 20. With the cost computations

described above, it can be shown that when production occurs,

it is always optimal to produce exactly the quantity demanded

for the interval being considered (Dreyfus and Law 1977).

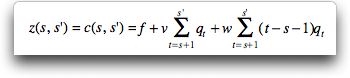

To express the decision objective in general terms let  be

the demand in week t, and let c(s, s')

be the cost associated with producing at time s to

satisfy the demands for periods s+1 to s'. The

cost function has three components. be

the demand in week t, and let c(s, s')

be the cost associated with producing at time s to

satisfy the demands for periods s+1 to s'. The

cost function has three components.

To illustrate, we calculate z(s, s')

for s = 0, d = 6 and s' = 6. The

parameter values are f = 30, v = 4 and w =

1.

|

| |

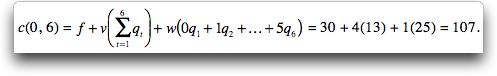

To implement the model in Excel, we again choose

the Line model option, but for this problem we use the Data

Form as option 2. This creates a two-dimensional table

shown below as starting in column N. We have placed the cost

parameters in column L. Only part of the table is shown since

it has 20 columns. The table entries compute values for c(s, d),

the cost of producing items at time s. The amount

produced is sufficient to cover the demand for d periods.

For example the entry in cell N17, 107, is the cost of producing

13 units at time 0 and paying inventory on the items until

they are consumed.

|

| |

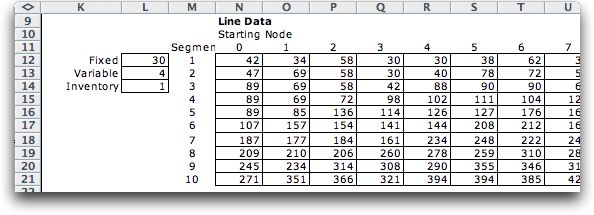

The Excel DP model requires no modification.

The decision objective formula is a direct reference to the

table.

|

| |

|

| |

|

The model requires a

state variable and a single decision variable.

Clicking the Solve button solves the problem.

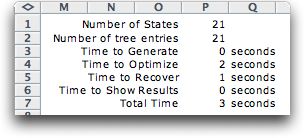

The solution statistics are below. There are 21

states.

Using the line partitioning model with this cost function,

the optimal sequence is (0, 6, 10, 13, 16, 20). The

table depicts the results. The first five components

of this sequence are production times; the corresponding

production quantities are 13, 15, 14, 14 and 24,

respectively. The total cost is 555.

|

|

| |

If a problem is

equivalent to the optimum line partitioning problem,

DP requires only a single state variable. The problem is very

efficiently solved. |

| |

|

|