|

|

To add a forecast, choose the Add Forecast command from

the Forecast menu. The dialog shown below is presented. The

field at the top shows the location on the worksheet of the

upper left corner of the forecast display. This option allows

an arbitrary placement of the forecast display and several

forecasts may be placed on the same worksheet.

|

| |

|

The Name field determines named ranges on

the worksheet. This name must be unique for different

forecasts. It must start with a letter and include no

spaces or punctuation.

The Data Columns field specifies the number

of individual time series that will be placed on the

display. It might be useful to have more than one if

the user has a several series to be simultaneously tracked

such as the stock prices in a portfolio or the sales

volumes for different products. Each time series will

have a separate forecast.

The Time Horizon is the number of

periods to be included in the series. This number can

be changed using the Change command. The History is

the number of periods of data used to obtain the first

forecast. All the methods require this warm-up period

to obtain valid forecasts. This history is important

because it limits several features of the forecast. For

instance the number of observations in a moving average

and the number of observations in a regression forecast

are limited to the number of periods in the history.

The forecast interval is also limited by the history.

|

|

| |

A nonzero entry in the Extra Data Columns field will

cause the add-in to create extra columns that are placed to

the left of the data columns. These might be useful for holding

associated information related to the data. For example on

the Investments page we

use a single extra data column to hold the dates associated

with closing stock prices.

A nonzero entry in the Extra Results Columns field

will cause the add-in to create extra columns in the display

that appear to the right of the forecasts. These might be useful

for additional processing of the forecasts. This is illustrated

on the Investments page

where we use several extra columns to make stock buy and sell

decisions.

When the Simulate button is checked, data will be

simulated using Monte Carlo simulation. The results are similar

to the Simulation command on the forecast menu, but

the data placed on the worksheet is fixed, rather than controllable

through simulation parameters.

When the Freeze Panes button is checked, the worksheet

window is divided into four sections and the panes are frozen.

This is useful for large data sets where the active data cells

may be far removed from the row and column titles.

The Seasonal button allows the analysis of time series

with cyclical variations. The number of data points in a cycle

is placed in the field below the button.

The Include Forecast button determines whether the

display will include forecasts for future times. For example

a moving average forecast places one column on the display

holding the moving average. When this button is checked, two

additional columns are also included, one holding forecasts

for future times and one holding error measurements for the

forecast. Usually one would check this button, but for some

applications future forecasts are not required. Again we illustrate

this on the Investments page.

The other pages of this section all include forecasts.

The dialog requires the selection of one of the forecasting

methods using the buttons on the right. In the remainder of

this page, we illustrate the various forecasting methods. |

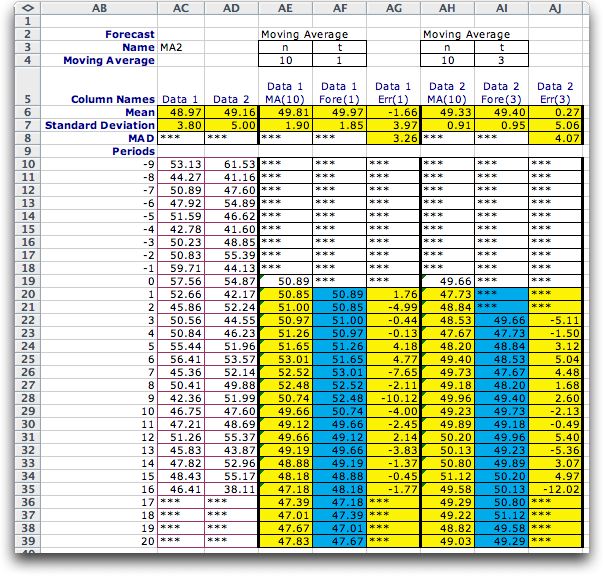

Moving Average |

| |

|

Clicking the OK button causes the add-in to construct

the form shown at the left. Cell C3 gives the name of the

data. This cell should not be changed. Cell D4 contains

the number of data points to be included in the moving

average. This number can be changed to observe the effects

of different lengths. It can be no greater than the history,

10 in this case.

The data is in column C. Cells C10 through C19 hold data

for the warm-up period. For a moving average of 10, there

must be at least 10 data points available for the first

forecast. The data shown is a simulated random variable

with a mean of 50 and a standard deviation of 5. Column

D holds the estimate of the mean of the time series. The

moving average estimates only the mean. Column E shows

the forecast. The time interval, t, for the estimate

is set in E4 by the user. For the example t is

2. The number can be changed but is limited from above

by the history. The entries in column E are offset by t periods

from the moving average value from which the forecast was

derived. For example, the entry in E21 is the forecast

for time 2 based on the moving average computed for time

0 in cell D19. The two values are equal because the moving

average assumes a constant for the underlying mean value

of the time series. The column is labeled Fore(2) to indicate

that it holds an estimate of the time series based on the

mean value estimated two periods earlier. |

|

| |

Column F computes

the forecast errors. The error is simply the difference between

the value observed for a period and the forecasted value. For

example, the entry for period 2 which appears in cell F21 is

the value of the data in period 2 (cell C21) less the value

of the forecast (cell E21).

The means and standard deviations of the columns are computed

in rows 6 and 7. The moving average column should have less

variability than the data column because moving average eliminates

some of the noise variability. The error column variability

depends on both the data variability and the variability of

the forecasts.

Row 8 (cell F8) shows the MAD or Mean absolute deviation of

the error results. This is sometimes used as a measure of forecast

quality.

In practice, one would fill in a table like this one period

at a time as data is observed. Data not yet available are indicated

by ***, as shown for periods 16 through 20. Moving averages

are computed for these periods because the moving average function

looks back the specified number of periods (10) and uses as

many numeric values as available. For example, the moving average

for period 20 (in cell D39) is the average of the five data

points for periods 11 through 15. |

| |

|

The selection of the number to be included in the moving

average is the prerogative of the analyst. If the mean

of the underlying time series is truly constant, the average

should be as long as possible. In reality the mean value

may be changing. If the forecast is to discover changes

quickly, the number in the average should be low.

The same series is shown at the left with 5 periods in

the moving average. The standard deviation of the forecast

has increased because the noise has more effect because

of the smaller number of periods in the average. |

|

Exponential Smoothing |

| |

|

The display at the left shows the same data with forecasts

provided by the exponential smoothing method.

This method has a single parameter Alpha. A small

value of Alpha tracks rapidly varying time series

better than a large value, but a small value is more affected

by noise. The value of Alpha for the example is

in cell J4. The default value is

2/(history + 1)

Alpha can be changed by the user.

The forecast for time 0 (cell J19) is computed by a moving

average with length equal to the history (10 in this case).

Exponential smoothing requires such an estimate to get

started.

The time interval of the estimate is in K4. The estimates

for the mean of the series are in column J and the forecasts

are in column K. Since exponential smoothing only estimates

the mean, the forecast will be the same as the estimate t periods

earlier. |

|

Regression |

| |

|

The regression method is similar to the moving average

method in that it uses a fixed interval to determine forecasts.

The example uses 10 periods. The method takes the last

10 observations and constructs a linear regression estimate

for the mean of the time series. There are two results

of the regression, a constant term labeled Reg. a, and

a linear term labeled Reg. b. Estimates are computed with

the linear expression:

Est(t) = a + bt

where t is the interval between

the time of the estimation and the estimated mean value.

For example, the estimate for time 4 (cell R23) is based

on the regression coefficients computed at time 3 (cells

P21 and Q21). With all values rounded to two decimal places,

this is

Est(2) = 49.95 + (0.22)(2) = 50.40

The numbers used by Excel have many significant

digits of accuracy, but when rounded values are shown the

results seem to have small errors. For the example we would

expect 50.39 as the result, but actually the value 50.40

is more accurate.

The data observed for time 4 (cell O23) is:

38.03, so the error for time 4 (cell S23) is

38.30 - 50.40 = -12.11

The regression method is useful for time

series that have a trend component. Again the choice of

the length parameter is important. For rapidly changing

series the length should be short. For slowly changing

series that can include a trend the length should be long.

The value of the length can be changed in cell P4, but

it cannot exceed the history. |

|

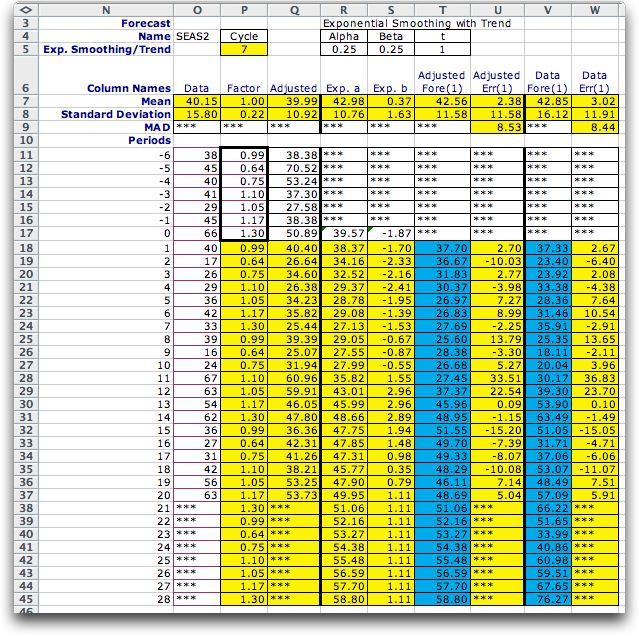

Exponential Smoothing with Trend |

| |

|

This method is also used when the series might have a trend.

It is similar to the exponential method, but also estimates

the value of the trend component. Like the regression method,

both the constant term and the trend are estimated. It has

two parameters, Alpha and Beta. The estimates

for time 0 are obtained with a regression forecast. |

|

More than One Forecast |

| |

|

The Add Forecast dialog allows for the analysis

of more than one series . The dialog is shown below for

two series.

The forecast is produced below using simulated

data. Both forecasts use the same method but may have different

parameters. |

|

Seasonal |

| |

To illustrate the

use of the Seasonal button, we consider a time series

that observe the visits to a web page. Data showing the visits

to the site for a 28 day period is shown below. It appears

that there is a weekly variation in the data with the fewest

visits on Saturday and Sunday. We have tabulated the first

three weeks at the top right with the total and average number

of visits per day. At the bottom right we divide the visits

by the average for each week to compute the relative number

of visits compared to the average. Finally we average these

over the three weeks to compute an adjustment factor for the

days.

To analyze the data we click the Seasonal button

on the Add Forecast dialog and indicate the Season

Cycle as 7. One week is specified as the history and we

provide room for 28 days of data.

The forecast is produced below with the data

placed in column O. Column P is for the adjustment factors.

The first 7 cells in this column hold the factors computed

above. The remaining cells in this column hold equations linking

to the first cells. Thus changing the factors in the first

7 cells will change the entire column. The adjusted data is

computed in column Q by dividing the data by the adjustment

factors. Columns R and S perform the exponential smoothing

with trend to forecast the adjusted data in column T. The forecasted

visits in column V are computed by multiplying column T by

the adjustment factors.

|

| |

|