| |

|

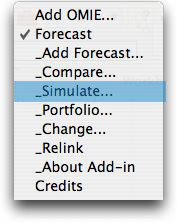

The Simulate option is for the comparison of different

forecasting methods on a single time series using simulated data.

The process is similar to the Compare option, but here the simulation

is live in that the model parameters can be changed on the worksheet

and the series and forecasts are automatically adjusted. The option

is useful to illustrate the impact of trends, steps and noise

on forecasts and their accuracy.

|

| |

|

The dialog allows selection of a name, time horizon, history

and number of extra columns. The check boxes at the bottom

select one or more forecasting methods. The fields to the

right of the check boxes indicate how many forecasts of each

type are to placed on the worksheet. |

|

| |

Clicking the data

model button presents the Model Data dialog. Here we set the

initial parameters of the simulated model. The same button

appears on the other options for setting the parameters of

the simulated data. In addition to determining the integrality

and nonnegativity of the data, the option allows the user to

introduce random changes in trend and random steps in the base

of the time series. For both steps and trends the probability

specified determines the chance that a change will occur at

any given period. The mean and standard deviation of the magnitude

of the change, if it occurs, is also given here. The Base SD

is the standard deviation of the noise added to the model.

The parameters are used with Monte Carlo simulation to determine

the time series. The model assumes that change and noise values

are governed by Normal distributions. |

| |

|

The simulation requires a number of additional columns

on the worksheet. The Hide Simulation button allows

these columns to be hidden. The particular model simulated

here has an initial trend of 1, but no step or trend changes. |

|

| |

|

On clicking OK a worksheet is created with the same

name as the forecast. The simulation parameters are placed

in the corner of the worksheet. Changing any parameter

changes the simulated series.

The columns showing the simulation are shown below. One

or more columns of random numbers appear first. The example

is affected by only noise so only column F is necessary.

The numbers in cells F11 through F40 are simulated from

a uniform distribution with range 0 through 1. The numbers

are controlled by a seed appearing in cell F9. The simulation

can be regenerated by using the Fill Down option

on the Change menu item. |

|

| |

Columns G though J

hold the base, trend and cumulative trend. The cumulative trend

is added to the base to determine the mean value for the model.

The Noise in column K is simulated with the Monte

Carlo method using the random numbers in row F. The noise values

are drawn from a Normal distribution with mean 0 and standard

deviation 5. The standard deviation is stored in cell B6.

The value of the time series is the sum of the model and the

noise. For the example we round this sum to the nearest integer. |

| |

|

| |

In the example, we use

both an exponential forecast and an exponential forecast with

trend. First consider the exponential smoothing results. With

simulation, we know both the series value and the model. Column

O holds the one period forecast error comparing the observation

in one period with the forecast in the previous period. Note

that the standard deviation of the error is approximately the

noise standard deviation. The error has a positive bias because

exponential smoothing estimates always lag for a series with

a positive trend. The model error computes the difference between

the model and the estimate from the previous period. The bias

in the model error is about the same, but the standard deviation

is much lower because the error does not include the noise variation

of the observation. |

| |

|

| |

When we include the trend

estimate, the bias for both observation errors and model errors

is much smaller. Again we note the smaller standard deviation

for the model errors. Although this example shows a negative

bias, the bias should tend toward zero as more observations are

included. With the chosen values of alpha and beta, the initial

estimate of the trend is reflected throughout the 20 period time

horizon. |

| |

|

To illustrate a more complicated simulation, we create

a second model with both step and trend changes. The model

dialog is at the left. |

|

| |

|

|

The parameters are on the left and the simulated time

series is shown below. We note two step changes in the

first three periods and four trend changes in 30 periods

of the analysis. It is useful to simulate complicated time

series to observe the response of forecast methods to various

kinds of changes.

Changing the parameters or the random number seeds, results

in a different simulated time series. |

|

| |

|

| |

|