|

|

|

Dynamic

Programming Models |

|

-

Deterministic Dynamic Programming |

|

|

|

|

| |

We use a problem from

the Models section

of this site to illustrate the use of the DP Models add-in for

a Deterministic Dynamic Programming problem. Go to the Investment

Problem page to see a more complete description.

A portfolio manager with a fixed budget of $100 million

is considering the eight investment opportunities shown

in Table 1. The manager must choose an investment level

for each alternative ranging from $0 to $40 million. Although

an acceptable investment may assume any value within the

range, we discretize the permissible allocations to intervals

of $10 million to facilitate the modeling. This restriction

is important to what follows. For convenience we define

a unit of investment to be $10 million. In these terms,

the budget is 10 and the amounts to invest are the integers

in the range from 0 to 4.

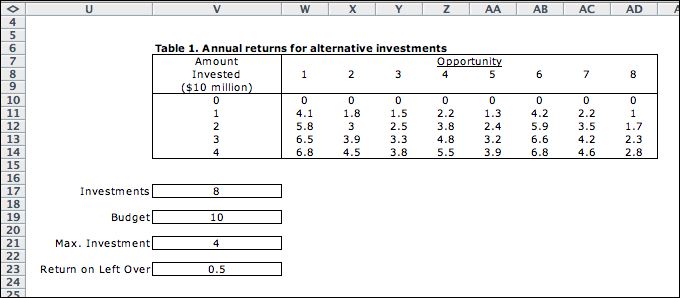

Table

1. Returns from Investment Opportunities |

Amount |

Opportunity |

Invested

($10 million) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

4.1 |

1.8 |

1.5 |

2.2 |

1.3 |

4.2 |

2.2 |

1.0 |

2 |

5.8 |

3.0 |

2.5 |

3.8 |

2.4 |

5.9 |

3.5 |

1.7 |

3 |

6.5 |

3.9 |

3.3 |

4.8 |

3.2 |

6.6 |

4.2 |

2.3 |

4 |

6.8 |

4.5 |

3.8 |

5.5 |

3.9 |

6.8 |

4.6 |

2.8 |

Table 1 provides the net annual returns from the investment

opportunities expressed in millions of dollars. A ninth

opportunity, not shown in the table, is available for

funds left over from the first eight investments. The

return is 5% per year for the amount invested, or equivalently,

$0.5 million for each $10 million invested. The manager's

goal is to maximize the total annual return without exceeding

the budget. |

|

Creating the Model |

| |

This problem is not

addressed by the DP Data add-in, so we create a problem

by choosing the Add Model menu item from the DP

Models add-in. Select the Deterministic DP option

and click OK. A second dialog asks for the parameters of

the model.

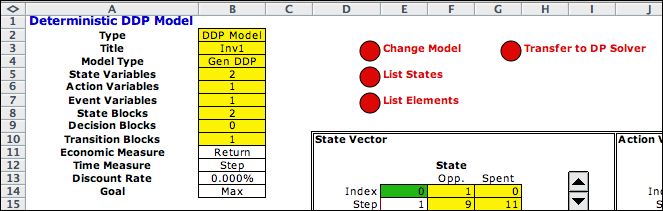

A deterministic DP has states and actions, but no events.

Click OK to initiate the model building process. The figure

below shows the top part of the form. The form is shown after

it has been modified for the investment problem. The goal is

to maximize the total return so we use a discount rate of 0%.

Data required by the analysis is placed to the right of the

model. The data is linked to the model using Excel formulas.

If the data changes, the model automatically adjusts.

|

Filling the Model Form |

| |

The figure below shows

the model form after it has been filled in. The yellow fields

hold formulas that should not modified. The green fields hold

computer generated results, but they can modified by the user

when debugging the model. The white fields hold formulas or numbers

provided by the user.

There are two state variables, the investment opportunity

and the amount of the resource already spent. The current state

(1, 0) is in F14 and G14. This is the initial state where

the first opportunity is being considered and none of the budget

has been spent. Rows 18 and 19 hold the lower and upper bounds

on the state variables. When constructing the Solver model,

the computer will consider all states within these ranges.

The actions ranges from 0 through 4 indicating the amount

to invest. The Return in L21 holds a pointer

to the data table. The return is a function of both state (the

opportunity) and the action (the investment). The action shown

invests 3 in opportunity 1 for a return of 6.5.

The model has a single transition block, starting in row 52,

that governs all transitions. The most interesting aspect of

this is the Change State vector. The number 1 is placed

in cell F58 because a transition always moves to the next opportunity.

Cell G58 holds the change in the budget spent with the current

action. In this case, it is the value of the action

given in cell L50. The figure shows that

the action 3 taken while in state (1, 0) leads to state (2, 3). |

|

| |

Notice there are two

state subsets starting at row 28. The first subset starting in

row 34 defines the exit states of the model. It is always necessary

to define these because the system must terminate. The

bounds on this subset specify that the final states all have

the first state variable equal to 9. The second subset, places

no additional restrictions on the state variables, so this

subset represents all states except those defined by the first

subset.

The figure below shows a final state (9, 5). Cell Q36 has a

formula to evaluate the final states. When 5 remains unspent from

the budget, the return is 2.5. Both state subsets are TRUE for

this example. The program always selects the top subset when

more than one condition is satisfied. |

| |

|

| |

The transition formula

holds for all feasible actions taken from all feasible states.

Some actions taken from feasible states do not reach a feasible

state, however. For example, the state is (4, 9) indicates opportunity

4 with an amount spent of 9. An investment of 3 results in a

transition to (5, 12). The transition is infeasible because (5,

12) is not a feasible state. Only transitions to feasible states

(those in the state list) are enumerated. |

| |

|

Enumerating the Elements |

| |

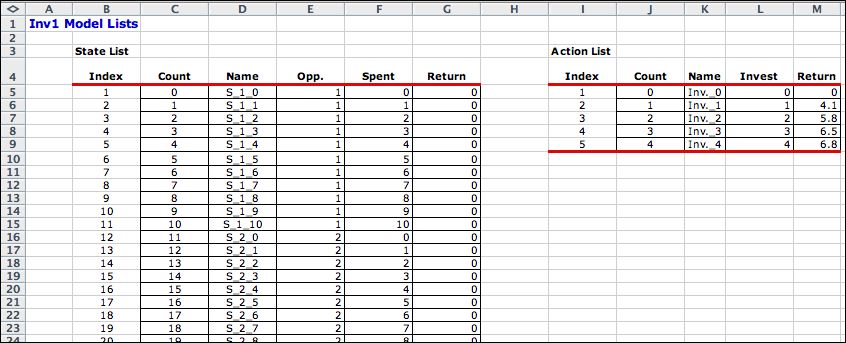

The DP Models add-in

enumerates all feasible states and actions and creates lists

of the elements of the problem. These are transferred to the DP Solver add-in.

The lists are placed on a separate worksheet called Inv1_Lists.

Parts of the lists are shown below. There are 100 states. |

| |

|

| |

|

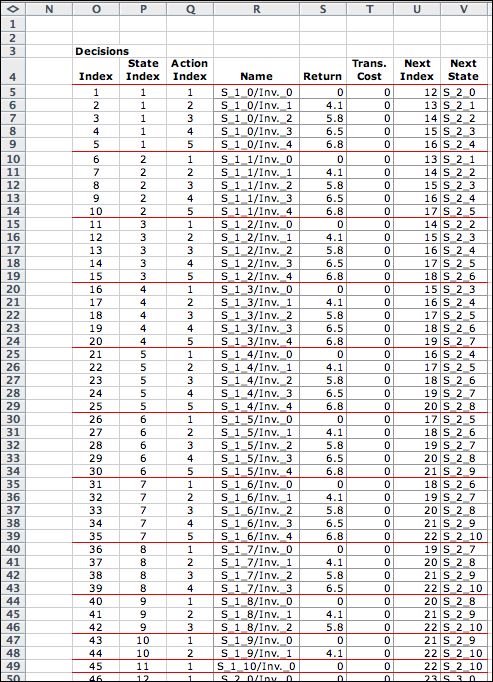

The decision list combines feasible

states and actions that lead to feasible states. There are

372 for this example. Only the decisions relating to states

referring to opportunity 1 are shown. |

|

The DP Solver |

| |

Clicking the Transfer

to DP button, copies the lists to the DP Solver format.

The top left of the DP Solver form is shown below after the problem

has been solved. The acyclic procedure

is useful in a case such as this one, where all states lead

to a state later in the state list. This is called an acyclic

state space. The acyclic procedure starts at the bottom of the

state list and progresses up, evaluating the optimum solution

for each state. Only one pass through the state list is required

for a problem with an acyclic state network. Most deterministic

DP models have this characteristic.

|

| |

|

| |

Part of the solution

is below. The Recover Optimum button at the top of the

page highlights states that comprise the optimum together with

the optimum actions. The value of the optimum policy is 22.3.

The figure shows that 2 units should be invested in opportunity

1, 1 unit in opportunity 2 and 1 unit in opportunity 3. |

|

| |

By hiding the rows for

the states that are not encountered by the optimum, the optimum

solution is clearly displayed. |

|

| |

|

| |

|

|