|

|

|

Stochastic

Programming |

|

-

Aircraft Allocation to Routes |

|

An illustration for simple recourse comes from a 1956 article

by Allen R. Ferguson and George B. Dantzig, The

Allocation of Aircraft to Routes - An Example of Linear Programming

under Uncertain Demand, Management Science, Vol. 2, pp

45-73 (1956). The numbers in this example come from the original

article and the description was adapted from the Roger Wetts

book. |

Deterministic Equivalent |

| |

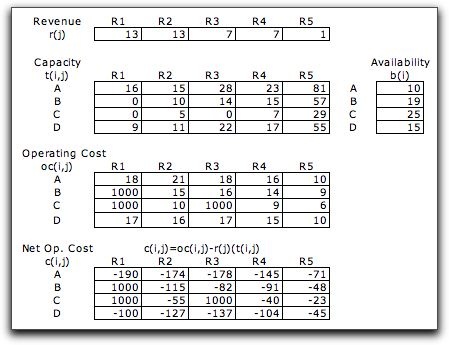

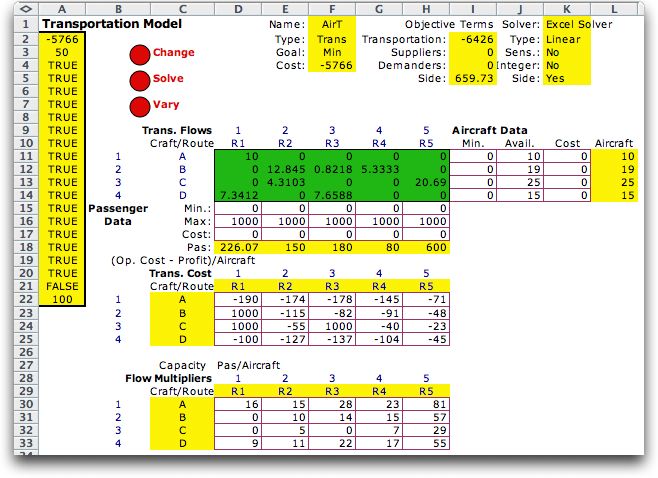

An airline has four aircraft

types (A, B, C, D) that fly five routes (R1, ..., R5). Data

regarding the aircraft and passengers are given below. The

figure comes from an Excel worksheet used to solve the problem.

The data reflects 1956 prices and is scaled. The data here

is linked to data items on the math programming model, so a

different instance can easily be constructed and solved. Revenue gives

the revenue per passenger on each route. Capacity is

the number of passengers per aircraft for each aircraft-route

pair. Operating Cost is the cost of operating

a single aircraft on a route. The Net Operating Cost is

the cost of operating the aircraft less the revenue for a full

aircraft. We express this as a negative number because we will

be minimizing the objective. Availability gives the

maximum number of each aircraft type to be scheduled. Some

aircraft cannot be used on some routes as indicated in the

tables as zero capacity and high operating cost.

Our goal is to find the number of aircraft to send on each

route to minimize the total net operating cost. If the number

of passengers willing to travel on each route were

known we could write this problem as a linear program. We write

the demand constraints as "<=" because it may not be optimal

to satisfy all the demand. The negative values of the objective

coefficients encourage the demand to be met, but the aircraft

availabilities and capacities may make that impossible.

This model has the form of a generalized transportation problem

because the variables are multiplied by non-unit coefficients

in the demand constraints. The transportation model feature

of the Math Programming add-in allows this variation by including

flow multipliers. The figure below shows the model

with the data of this instance. The

aircraft

capacities are reflected in the Flow Multiplier matrix.

The demands used in the figure are the expected passenger

demands computed from the probability distributions given

later.

The figure shows the optimum solution with the expected demands.

The solution does not meet all the demand for route 5. Indeed

there is no feasible solution that meets all the expected demand. |

|

| |

The solution above allows fractional numbers of

aircraft, but of course this is not practical. When we require

that all

variables be integer, the solution meets more demand but has

less profit. |

|

Recourse Model |

| |

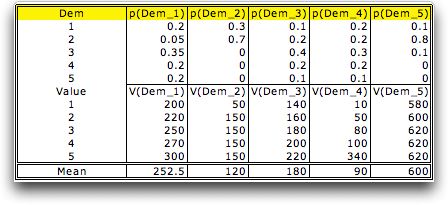

The deterministic solutions do

not recognize the uncertainty in demand. The demand for the

routes are independent random variables with the values and

probabilities shown in the table below. The table was constructed

with the Add Random Variable command from the Random

Variables add-in. The case shown is an indexed distribution.

There is a column for each route with Dem_k indicating

the demand for route k. The probabilities are given

at the top of the form and the values of the discrete random

variables on the lower part of the form. For example, route

1 has demand of 200 with probability 0.2.

When considering randomness, the aircraft allocation

problem is a simple recourse model. We must choose the allocation

of aircraft to routes before the demand is known. After the

demand is realized we find there is either a shortage of demand

(assigned capacity exceeds demand) or an overage of demand

(demand exceeds assigned capacity). In case of overage, the

aircraft flies fully loaded and there is no penalty since the

original objective coefficients were computed assuming full

use of capacity. When there is a shortage, the aircraft flies

with empty seats. The

unit penalty assigned is the revenue not

received. The simple recourse model is below. The z variables

compute the total capacities allocated to the routes. We use

general notation to allow any number of points in the distribution,

but for the example, there are five possible demands for each

route.

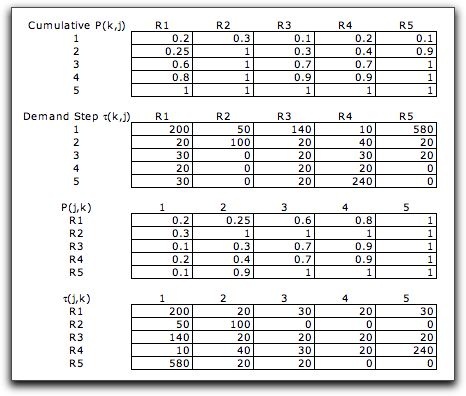

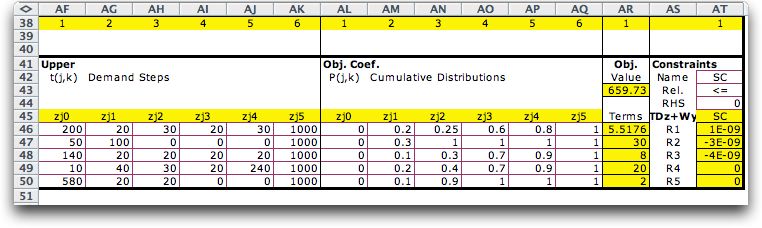

For convenience we have computed the cumulative

distribution and the step intervals below. We have also created

the transpose of the two matrices because the data is used

in the model in the transpose form.

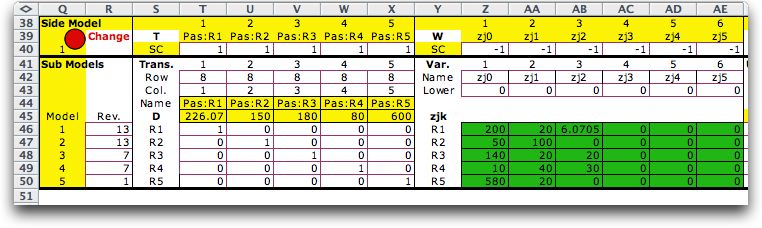

To solve this problem, we create a master

problem and subproblems. The master problem has the same

format as considered earlier except we do not restrict the

maximum passenger flow (row 16). The solution shown is optimum

for the master problem when the side problem constraints

and variables are included. The "Yes" in K5 indicates that

the side problem is to be included in the optimization. |

|

| |

The submodels of the side

problem are presented in two parts below. For a side problem

linked to a transportation form, the references

to the linking variables require two indices. These references

are on rows 42 and 43 in columns T through X. Since the transportation

variables are arranged in an array, each linking variable

is referred to by row and column indices, rather than by a

single index as with an LP or network model. The linking variables

in this case are the total seats allocated to each route. These

numbers

are in row 18 of the master problem. For purposes of the indices

the transportation flow matrix is extended to include the flow

received row (row 18 above) and the flow shipped column (column

L). The index for the flow received row is 8. The relevant

cells represent the seats allocated are (8,1), (8,2),...,(8,5).

The variables in columns Z through AE are the parts of the piecewise

linear representation of the expected recourse cost. The parameters

for these variables are in the second part of the side model display.

The upper bounds are the demand steps and the objective coefficients

are the cumulative probabilities. The shortage costs for the routes

are the weights in column R. |

|

| |

The recourse model can be solved

for integer flows by simply requesting that the variables be

integer through

the Change button at the top of the master problem.

Results are compiled below for the solutions without and with

integer restrictions. The expected value solutions, on the

left, restrict the demand met by the allocation to the expected

value of demand. The recourse solutions, on the right, recognize

the uncertainty of demand through the recourse costs and optimize

the net profit with an allowance for demand shortages. Quite

different solutions are obtained. Since we are minimizing,

the expected value solutions have better (more negative) net

costs. This is because they assume all seats allocated are

used. In fact, seats may be empty so not all revenue will be

realized.

|

| |

Models representing

uncertainty are not too large with simple recourse.

The example above could have been easily adjusted for more

complex

probability

distributions. The methods of the Approximation page

could have been used for demands with continuous distributions.

This problem is most readily modeled using the

transportation format of the Math Programming add-in. The side

model feature is adaptable to this structure. With a side model,

the problem is actually solved as an LP by the Excel Solver.

The free version of the Solver can handle only 200 variables,

so the number of master and subproblem variables cannot exceed

that amount. The

side model grows only linearly with the number of random

demands, so quite large models can be constructed on an Excel

worksheet. The ability to solve these models depends on the

capacity of

the Solver.

The Jensen Network Solver does not have

the ability to solve models with side problems. |

| |

|

|