|

With the no recourse situation,

we must fix the decision variables before the random variables

are realized. On this page we investigate some simple strategies

for finding solutions. We will finally conclude that these

strategies are not very satisfactory. The following pages suggest

better, but more difficult, solution methods.

One strategy is to replace the random variables by their expected

values and solve the resultant deterministic model. We might

ask how well this expected value solution serves as

the solution

to

the stochastic

problem. The expected value solution to our example problem

is shown below. Since the expected values of the random variables

are 0, the RHS values are just the constants originally proposed. |

|

| |

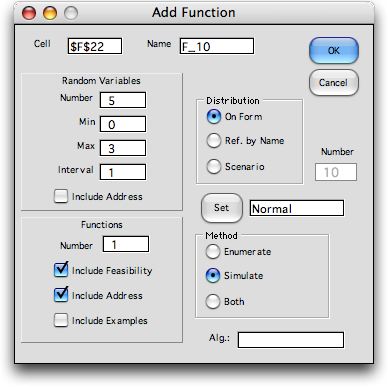

To evaluate this solution in a stochastic setting,

we create a function model below the LP model. We create

the model by calling the Function command of the Random

Variables add-in. Five random variables are defined, each

with a Normal distribution. Note that the algorithm field is

blank. We use the Include Address option.

The LP model is the same

as

before,

but now we

allow

the RHS

values

to vary

randomly

but do not solve the LP for each sample. For each sample, the

solution variables are fixed at the values

obtained with the expected RHS. The objective value does not

change because the decision vector is fixed. The only question

is: What is the probability that this solution will be feasible?

We place logical expressions

in G15:G19 to indicate when the constraints are feasible.

Cell G31 holds the address of the function value (the objective

function of the LP), and cell G33 holds the address of the

logical expression that returns TRUE if the solution is feasible

and False if it is not. The LP solution on the worksheet is

optimal when the RHS values are the expected values, so this

solution is feasible. With the Include Address option,

cells G32 and G34 are initially blank. They are filled with

the appropriate transfer expression when the simulation begins. |

| |

|

| |

When we simulate the model for this

case we do not solve the model for every sample. The results

are shown below. The objective value shows no variability since

the decision variables remain the same for all samples. The proportion

of feasible solutions is, however, only 5%. The probability that

this fixed solution is feasible is very small. |

| |

|

| |

These results should

not be surprising. With the expected RHS values, four of the

five constraints are tight in the deterministic optimal solution.

Since the RHS values are Normally distributed, there is a

50% that a tight constraint will be violated when the random

RHS is realized. Even if the single loose constraint is never

violated, the probability that all the tight constraints are

satisfied is 0.5 raised to the fourth power or 0.0625. The

simulation shows that only 5% if the simulated RHS vectors

result in feasible solutions.

One might ask, how should the problem with no

recourse be solved? The answer to this question is the provence

of stochastic programming. |

Combining wait-and-see

Solutions |

| |

One suggestion often made for

this kind of problem is to solve the problem as if we could

wait

and see the random realizations and then combine the wait-and-see

decisions in some way. We do this for the example by creating

a new math programming model identical to the wait-and-see

model considered earlier, but

create a simulation form that records the values of the decision

variables as well as the objective. The form is below. We

now have 11 functions defined. The first is the objective

function and the remaining ten are the values of the decision

variables. All eleven functions have the same feasibility

equation. A solution is recorded only when the LP has a feasible

solution. |

|

| |

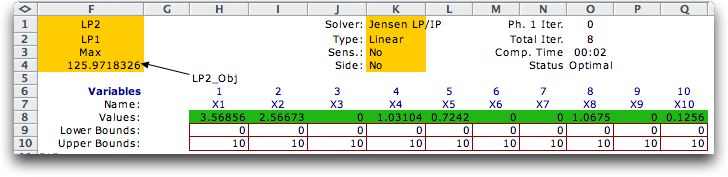

We simulate the random

variables, solve the LP for each sample point and record the

observed function values. The results from 100 observations

is below. None of the solutions were infeasible as indicted

by cell G37. This is not surprising since the wait-and-see

solutions observe the RHS vector before finding the solution.

Row 39 shows the mean values for the 100 observations.

The first entry shows the mean objective value of 125.97. The

remainder of the entries on row 39 show the average values

of the decision variables. Variables X1, X2, X4, X5, X8, and

X10 are nonzero for at least some of the observations. |

| |

|

| |

It is interesting to compare these

results against the results for 1000 observations. Row 39 shows

that the same set of nonzero variables except for X6. This variable

was nonzero for a single selection of random variables. |

| |

|

| |

The first 20 simulated results are

shown below to illustrate the variability of the wait-and-see

solutions. |

| |

|

The Average Solution

|

| |

To continue, we impose

the average of the wait-and-see

solution on

the LP model.

|

| |

To evaluate this solution, we simulate

this model with the solution fixed as above. Of course, since

the solution is fixed there is no variability in the objective

function. The results of 1000 simulated RHS vectors indicate

that the solution is feasible for only 6.5% of the observations. |

| |

|

| |

We have investigated two solutions to the

no-recourse problem, the expected value solution and the mean

wait-and-see

solution. The two solutions are shown in the table. The combined

wait-and-see

solution has a slightly higher objective value

because it is not feasible for the expected RHS vector. Neither

fixed solution has a very high chance of being feasible when

there is randomness in the RHS vector.

When uncertainty

affects the RHS values of the constraint coefficients, there

is always a chance that some constraints will be violated by

a fixed solution. Choosing a solution involves a tradeoff

between

the risk of infeasibility and the expected value of the objective

function. Chance Constraints, described on the next

page, gain some control of the feasibility probability, but

again we will be left with a variety of alternative solutions.

Solution |

Objective Value |

Feasibility Probability |

| Expected Value RHS |

125.61 |

5% |

| Combined wait-and-see

|

125.97 |

6.5% |

|

| |

|