|

|

|

|

Inventory

Theory

|

|

-

Deterministic/Infinite Replenishment/No

Shortages

|

| |

|

In this section we

consider an isolated inventory in which external demanders remove

items from the inventory and external suppliers replenish the

inventory. Rather than demand occurring in a random and uncertain

manner, we assume that items are withdrawn from the inventory

at a continuous rate. Replenishments to the inventory are of

a fixed size q, called the lot size The time between

when a replenishment is requested and when the amount enters

the inventory is called the lead-time. We assume that the lead-time

is zero or a constant. The resulting behavior of the inventory

is shown in Fig. 1. We use this deterministic model of the system

to explain some of the notation associated with inventory. Because

of its simplicity, we are able to find an optimal solution to

this deterministic model. The solution specifies the optimum

lot size. This appears in many texts on operations management

with the name economic order quantity or EOQ. |

Infinite Replenishment Rate and

No Shortages |

| |

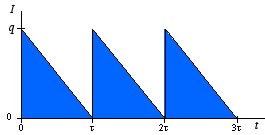

The first model considered

is illustrated by the figure below which shows the variation

of the inventory level with time.

Figure 1. Inventory with Infinite Replenishment rate

and no shortages

|

The figure shows time on the horizontal axis

and inventory level on the vertical axis. We begin at time

0 with an order arriving. The amount of the order is the lot

size, q. The lot is delivered all at one time

causing the inventory to shoot from 0 to q instantaneously.

Material is withdrawn from inventory at a continuous demand

rate, D, measured in units per time interval. We are

assuming that the material is withdrawn in a continuous fashion,

rather than in discrete units, so we show the inventory level

declining as a straight line. After an amount of time q/D,

the inventory is depleted. At that time another order of size q arrives

and the cycle repeats. The cycle time is  . .

The inventory pattern shown in the figure is

obviously an abstraction of reality in that we expect no real

system to operate exactly as shown. The abstraction does provide

an estimate of the optimum lot size, called the economic

order quantity (EOQ), and related quantities. We consider

alternatives to those assumptions on later pages. |

Formulas for Instance Results |

| |

Click buttons to see the notation

|

Here

we derive the formulas for the results for an instance.

An instance is defined by a collection of inventory parameters

and a value for the lot size q. Click the buttons

on the left for a description of the notation for parameters

and results.

These formulas are implemented in the Inventory add-in. |

|

|

To construct a mathematical

model describing the economic costs or profits associated with

the inventory system, we show the cash flows below. This figure

is a mixed representation of discrete as well as continuous

cash flows. The arrows represent amounts paid or received at

points in time. The areas represent continuous cash flows given

by rates. Amounts appearing above the 0 axis are revenues, while

amounts below are expenditures or costs.

The table below shows the various revenue and cost components

and their respective cost rates. In all of the following, we

assume that the parameters are nonnegative and that q

> 0.

| Item |

Amount during a cycle |

Cost or revenue rate |

Ordering Cost

In each cycle an order is placed for

the quantity q

|

A |

|

| Product Cost |

Cq |

|

| Holding Cost for Product

in Inventory |

Linearly varies from Hq

to 0 in each cycle |

|

Revenue from product Sales |

Rq |

RD |

For this model there is a single decision variable that is

the lot size or the replenishment, q. All other quantities

are a function of q. The inventory cost is a strictly

convex function of q, so there is a unique global minimum

with respect to q.

Additional quantities associated with the inventory policy

are derived below.

When the lead time is greater than the

cycle time, an order for replenishment must be placed

more than one cycle before the order is delivered. The

add-in performs this more complicated computation.

|

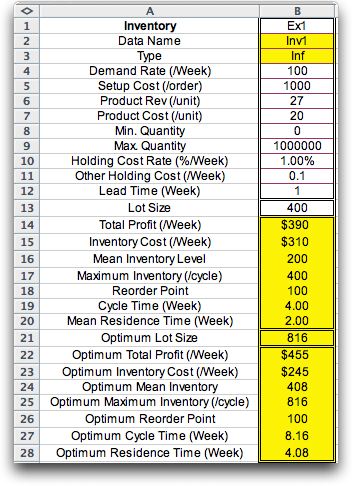

The measures are computed below for the example using a lot

size of 400 units. This is called an instance of the inventory

model. The figure shows a single cycle of the inventory pattern.

|

Optimum Policy |

| |

For determination of the optimum

lot size q*, the unit revenue and unit cost can be

neglected and we write the expression for the cost rate for

operating the inventory.

Since the second derivative is positive

for positive parameters, the inventory cost function

is convex and the solution for q* is a global

minimum.

|

When q* is between the minimum and maximum lot sizes,

the inventory measures with the optimum lot size are found by

substituting q* into the instance formula.

At the optimum, the holding cost is equal to the setup cost.

We see that optimal inventory cost is a concave function of

product flow through the inventory, indicating that there is

an economy of scale associated with the flow through inventory.

The optimal lot size increases with increasing setup cost and

flow rate and decreases with increasing holding cost.

The table below shows the parameters and instance results as

well as the results for the optimum lot size (q*= 816).

|

| |

|

|