|

|

|

Investment

Economics |

|

-IRR/RIC

|

|

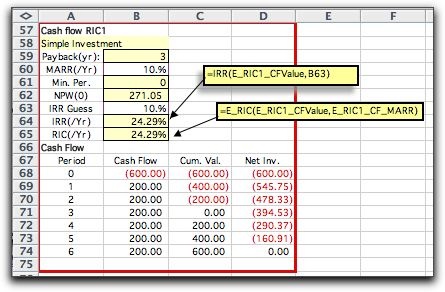

The IRR of a project is its Internal

Rate of Return. The IRR is the interest rate that makes the

Net Present Worth (NPW) of the project equal to 0. It is a measure

of merit of the project, and we say that a project is acceptable

if its IRR is greater than the minimum acceptable rate of return

(MARR). Excel has a built-in IRR function illustrated for example

1 in the figure below. The function has two arguments. The first

argument is a range of cells on the worksheet. For the example,

the range consists of the cells B26 through B31. This range has

the name E_Proj1_CFValue. The function assumes that the numbers

in the range are the cash flows for a consecutive series of times

which, for the example, are the times 0 through 6. The second

argument is a guess that is used to initiate a numerical search

for the IRR. For the example this argument points to B20 which

holds the value 10%. When the IRR is unique, this guess is not

important. When a project has more than one positive IRR, the

guess determines which solution is displayed. |

| |

Example 1

|

| |

The add-in provides a second function

called the E_RIC function. RIC stands for Return on Invested

Capital.

This is a user-defined function and we

identify it with the prefix E_ so that it appears along with

the other user-defined functions of the Economics add-in. Again

this function has two arguments. As for the IRR function, the

first function is a range holding a series of cash flows. The

second argument is the rate the organization earns for investments

outside of, or external, to the project being considered.

For the example we use the MARR is in cell B17, named E_Proj1_CF_MARR

for this external rate.

The RIC is related to the IRR, and it is defined as the interest

rate that makes the net invested capital equal to

zero at the end of the project life. For Example 1, the RIC

and the IRR are the same. This is always true for simple investments.

We illustrate the RIC computation in the figure below. |

| |

The Net-Invested

Capital for Example 1

|

| |

We call the figure shown above

the net-invested capital (or net investment). For

each discrete time interval we compute the net-invested capital

as:

According to the formula, the cash flow grows at the return

associated with the investment being evaluated for negative

cash flows and with the external return for positive cash flows.

The RIC is the interest rate that makes the cumulative

cash flow at time N (the project life) equal to 0. The

figure above shows the net investment for the rate 24.29%.

For this rate the value at time N is zero, so the RIC

is 24.29%. For this example, as for every simple investment,

the cumulative cash flow is always negative and the IRR and

RIC are the same because there are no positive cumulative cash

flows.

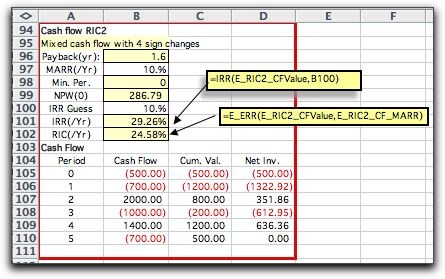

To illustrate a case where they are different, consider the

cash flow for example 2. |

| |

Example 2

|

| |

This is a mixed cash

flow, because we see that the cash flow column has three four

changes. An initial period of investment at times 0 and 1 are

followed by a large return at time 2. Then another investment

at time 3 is followed by a return at time 4, and finally another

investment at time 5.

Plotting the net investment for this case for

the interest rate 24.58%, we see that the future value is not

always negative. At times 0 and 1, the net investment is negative

and we apply the 24.58% rate. At time 2, the value becomes

positive and for the interval from 2 to 3, and we let the cash

flow grow at the MARR rate (10%). The net investment changes

sign from positive to negative at time 3 and negative to positive

at time 4. For this case the IRR is about 29% and the RIC is

about 25%. |

| |

The Net-Invested

Capital for Example 2

|

| |

Although both the

IRR and RIC are measures of merit, the RIC seems more rational

for mixed investments. As in example 2, the project is an investment

for the first two periods and in period 4, but during periods

3 and 5, the project is a lender. The project itself is not

making money by its own actions in periods 3 and 5, but rather

it is loaning money to the investor. During this period the

project funds are earning the external rate of 10%. The return

during these periods is better reflected by the MARR.

In addition to being a more reasonable measure,

the RIC has the advantage that it has at most one solution

for a given project, while the IRR may have more than one solution

for non-simple investments. The RIC computation will fail if

there is no interest rate for which the cumulative RIC cash

flow is zero at the end of the project. Even when the IRR

has only one solution for a cash flow with positive

net investment the RIC will be different.

We should point out that a number of ways have

been suggested to address the multiple root case associated

with the IRR. The most popular seems to be the modified

internal rate of return (MIRR). This method uses two external

rates one for positive net investment, as used here) and one

for negative net investment. Excel provides the MIRR function

that computes this measure. The MIRR function is extensively

discussed at several Web sites and in popular text books on

Engineering Economics. The MIRR function can easily be applied

to the cash flows provided by this add-in. We have programmed

the RIC function because it seems more rational to this author.

It is also described on the Web. |

| |

|

|